By now you have probably the other parts of my journey but I will list them here for you: –

Part one , Part two, Part three, Part four

In this post, my decision to go into Betfair trading, and all those other things!

Quitting a career, not just a job!

So I had taken the great leap into the unknown. For years I’d worked diligently up the corporate ladder and could have stayed in a senior position, but had now stepped off. At the back of my mind was the thought that if I didn’t do it now, I probably never would. So even with a young family in hand and a mortgage, I took the jump.

But then a real soul searching period set in. When people asked me what I was going to do in my new ‘job’, I tried to explain this neat thing I had been doing on betting exchanges. But as soon as the word ‘BET’ came up, everybody thought I had gone bonkers.

Looking back, you can sort of understand why people would be sceptical. How many people had claimed to find the ‘ultimate’ way to win by gambling, only for economic reality to eventually dawn? But, in fact, I had found a way to do something that was ‘impossible’, and it was the making of me.

Realising that even if the world set it’s stall out against you, it didn’t matter, was a revelation. It gave me the courage to try new things, be more adventurous and It also taught me not to be too worried about taking well thought out risks. It also taught me to be self-dependent and not to fear trying things just because people were trying to put me off. It was a real eye-opener and led me onto many more new paths. My confidence got a massive boost

Another epiphany

When I started afresh; At first, I wasn’t completely sure that I did the right thing. I wasn’t sure if the anything I was going to do was viable or not. Betfair trading was new, unheard of and pretty much a shot in the dark.

Like everybody starting out afresh, I had to find my feet. But the harder I tried and the more effort I put in, the results start to come. As the months wore on I realised that for every dead end I discovered there was an equal number of clear paths. This was another epiphany for me and has shaped the way I think about risk. It took until this happened, for me to realise that if you look for opportunities; you tend to find them. If you look for problems, you tend to find them too! But that shouldn’t be your role.

At the end of the day good and bad luck are created in equal proportion; you just need to keep your eyes open for the good stuff. It isn’t much you can do about the bad! I learnt that a lot of people spend too much time trying to avoid the bad by looking for it, they often find it.

It was an important step for me, as it radically changed my view on risk and trading in general. But it also changed my view about people. I started to realise that people who are persistently negative and disparaging were toxic and could safely be ignored. You should do everything to stop people like this infecting your mindset. Surrounding yourself with the right people was the way to go!

I started to realise that early in my life I’d been a bit too cautious and had an over pessimistic outlook. Now, there was no stopping me!

Early markets and a valuable trading lesson

Being into the market so early on, the first 18 months were hard. For starters, there wasn’t as much liquidity as there is now. But I managed and I also learnt a valunble lesson to learn to adapt as the market shifted around you. But the longer I went on, the more I was convinced that I had done the right thing. What was particularly hard for me back then was that there was nobody to learn from and no structure to what I was doing. I couldn’t compare notes or share my good or bad days. I had no idea if I was on the right path, I had to learn and create on the fly.

This taught me some great lessons in how to construct strategies. I spent a lot of time after each session trying to understand if what I did was right and what I did wrong. I worked incredibly hard to cut out as many errors as I could. I learnt that a lot of positions mature into profit even if you don’t get the entry point right. So while entry points are important, managing your exposure to losses turned out to be a key tactic.

Being in early has taught me how to approach formative markets and how they are likely to mature. It’s been important to understand that so that I can stay one step ahead of the curve. Which is something I’ve managed to do for nearly 20 years now. I owe that longevity to the difficult start I had as it taught me to never take anything for granted and to carefully anaylse what you were doing so you could learn what was working and why.

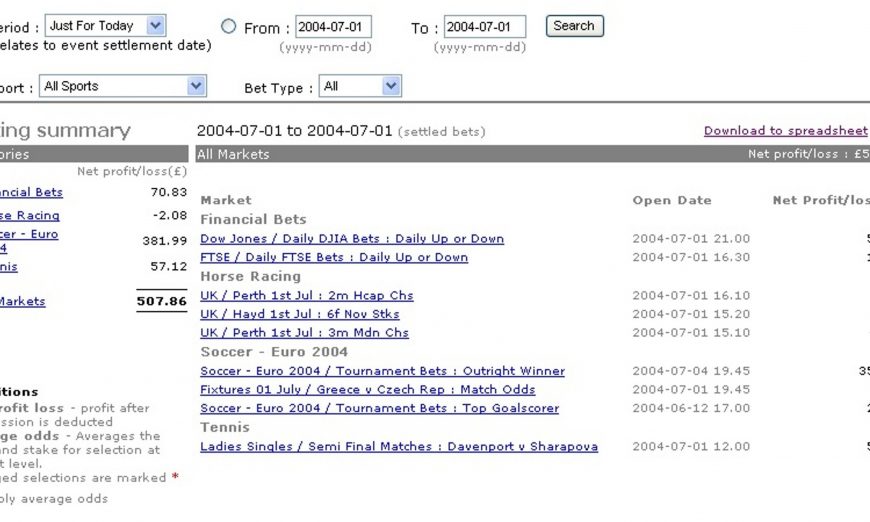

When I started to get a full understanding of everything I was doing, I just started to push the boundaries. I started increasing stakes and the depth and breadth of what I was doing. Things were really starting to look up.

I’ll continue to the series to bring you up to modern times. Up next, the birth of Bet Angel and my discovery of horse racing.