Discounted opinion in sports trading

Here is a little-discussed aspect of trading, discounted opinion. First let’s explore what it is?

Discounted opinion pre off

When a market is formed everybody has had a prod a what the odds should be. In some markets, this is obvious; in others less so. But generally, a convergence appears. Unless there is any significant change, that’s the way the market stays until the event starts.

Discounted opinion in-play

When the market gets underway, an opinion forms and the odds shift to reflect that. Of course, that has to happen as if a goal is scored and will also happen if no goals are scored; the odds must also most.

However, there is soooo much more to it that just that. I’m not just talking how odds move to the things we know, I’m talking about this more subtle things that are being discounted in the market. Things like, how the match is playing, how strong one team looks to the other, the number of chances being created and so on.

The interesting thing about this market state is that it’s subtle and implied and can be difficult to spot. I use a model to look at ALL matches that I have ever traded to see how the what variation is present. The market will regularly swing away from the mean and this shows all the discounted opinion in the market. When you see this a trade could be on if you differ with an opinion. Always remember opinion can be emotionally driven as well as logically driven.

Obviously, if you don’t have a reference point it can be a little tricky, but it’s not impossible.

Exactly the same, but different

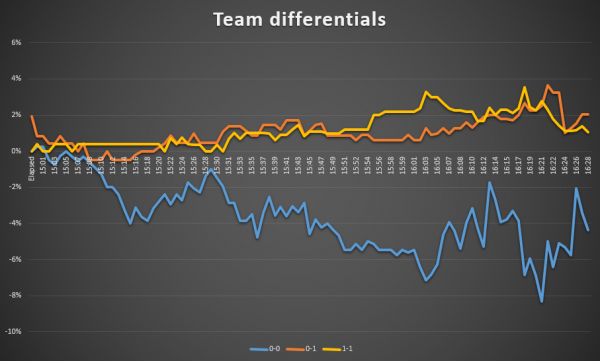

Take a look at the graphs below. I compared two matches that by all accounts were identical. The odds and other metrics were spot on. What we are showing in the graph, is how the correct scores varied over the course of the match.

You can see that one match was favouring the lack of goals and one was was not. The fact is that one match ended up 0-0 and the other 0-1. But value was created on both because of the variation in the long term average. It also shows where value is created in the market as the two matches can not be the same or similar and show differing evolutions.

Any academic will tell you a market is efficient, this sort of pees all over that proposition. The market is dynamic and adjusts to the underlying value, but also to the emotive pattern of betting behaviour and that is why you will always be able to get money out of the market, if you know where you are looking.

Category: Football trading strategies, Trading strategies