Gold

- oddstrader

- Posts: 344

- Joined: Fri Apr 16, 2010 4:55 pm

- Location: Surrey

The most useless resource but everyone wants it, produces nothing does nothing but every culture loves it. a bit like katie Price

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

But the point is that it is genuinely rare and you can't make any more of it. Unlike currencies where trillions can be magically created by central banks at the touch of a button and loaned into existence by primary dealing banks.oddstrader wrote:The most useless resource but everyone wants it, produces nothing does nothing but every culture loves it. a bit like katie Price

Gold and silver have been used as a means of exchange for thousands of years for very good reason.

- oddstrader

- Posts: 344

- Joined: Fri Apr 16, 2010 4:55 pm

- Location: Surrey

point taken and well made, its just one of those items in life that i dont understand, it may be precious and limited but its still useless, unless you are trying to attract a member of the opposite

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

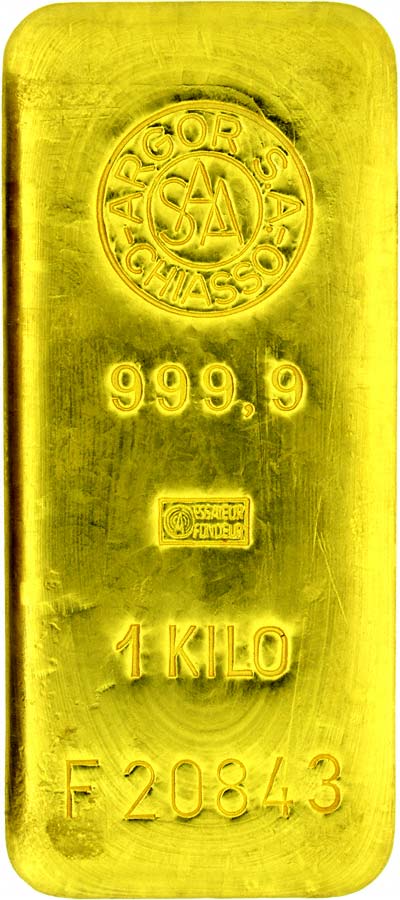

pretty useless yeah, but quite beautiful!...oddstrader wrote:point taken and well made, its just one of those items in life that i dont understand, it may be precious and limited but its still useless, unless you are trying to attract a member of the opposite

ps. I don't own that, but I wish I did.

'There is not nearly enough physical gold to satisfy all paper gold in existence by a factor of about 100x'.

From http://www.zerohedge.com/article/golden ... sical-gold

If enough people think 'I don't want a piece of paper saying I own gold. I want the yellow stuff in my safe.' then surely the risk is that there will come a point when people are told 'Sorry, but we can't lay our hands on any gold'. If that happens, we could get the mother of all bursting bubbles...

BTW, gold is still rising in price.

Jeff

From http://www.zerohedge.com/article/golden ... sical-gold

If enough people think 'I don't want a piece of paper saying I own gold. I want the yellow stuff in my safe.' then surely the risk is that there will come a point when people are told 'Sorry, but we can't lay our hands on any gold'. If that happens, we could get the mother of all bursting bubbles...

BTW, gold is still rising in price.

Jeff

You do not have the required permissions to view the files attached to this post.

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

Gold now $1500+ and silver's rise is relentless (up 70% in 3 months).

US AAA credit rating now under threat and the $ getting trashed. It's only political pressure that has prevented a downgrade.

The 'recovery' is no such thing. Pathetic levels of growth are being achieved by massive stimulus designed to stop asset prices collapsing (as they should have done and needed to).

Bernanke won't stop printing until they carry him off to the lunatic asylum.

IMHO the real culprit is globalisation - the temporary 'benefits' have worn off and China is now exporting inflation - it was always gonna happen.

The short-termist economic thinking of the west is coming home to roost.

Protect yourselves!

US AAA credit rating now under threat and the $ getting trashed. It's only political pressure that has prevented a downgrade.

The 'recovery' is no such thing. Pathetic levels of growth are being achieved by massive stimulus designed to stop asset prices collapsing (as they should have done and needed to).

Bernanke won't stop printing until they carry him off to the lunatic asylum.

IMHO the real culprit is globalisation - the temporary 'benefits' have worn off and China is now exporting inflation - it was always gonna happen.

The short-termist economic thinking of the west is coming home to roost.

Protect yourselves!

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

Yep. That reverse currency nonsense is wearing thin with the BRICs.

The UK and Europe are bankrupt too, but at least the Europeans have raised rates slightly and are starting to realise that ever cheaper money is not the solution.

I despair of the US, and our very own Bernanke, King, will resign before the end of the year IMO - he has failed by any measure.

Gold is the ultimate reserve currency and has been for thousands of years.

The UK and Europe are bankrupt too, but at least the Europeans have raised rates slightly and are starting to realise that ever cheaper money is not the solution.

I despair of the US, and our very own Bernanke, King, will resign before the end of the year IMO - he has failed by any measure.

Gold is the ultimate reserve currency and has been for thousands of years.

Hi Frank

I have to agree that the outlook is pretty grim...

A mate of mine's son graduated from Cambridge last year with a 2:1. He's now working in his local M&S. That about sums up the opportunity that's out there.

When you're competing in a world that's becoming ever smaller due to technology, you need an edge. I don't see what Britain's edge is. Too many of our young people are graduating with frankly useless media studies and sociology degrees, rather than taking vocational courses. And there is a culture of entitlement, rather than one of striving for excellence. It's as if, even though the Empire has long ago vanished, some people think that, just because they were born English, the laws of nature are distended in their favour (to paraphrase a novel whose name I forget).

Jeff

I have to agree that the outlook is pretty grim...

A mate of mine's son graduated from Cambridge last year with a 2:1. He's now working in his local M&S. That about sums up the opportunity that's out there.

When you're competing in a world that's becoming ever smaller due to technology, you need an edge. I don't see what Britain's edge is. Too many of our young people are graduating with frankly useless media studies and sociology degrees, rather than taking vocational courses. And there is a culture of entitlement, rather than one of striving for excellence. It's as if, even though the Empire has long ago vanished, some people think that, just because they were born English, the laws of nature are distended in their favour (to paraphrase a novel whose name I forget).

Jeff

superfrank wrote: The short-termist economic thinking of the west is coming home to roost.

Protect yourselves!

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

I admire what Cameron is trying to do but Britain is still f*cked whatever they do/achieve.

The artificial wealth created during the credit boom needs to be destroyed to cleanse the system. But King's plan is to allow those who received this phoney wealth to keep it (by protecting asset prices at all costs), while impoverishing the young and future generations.

The artificial wealth created during the credit boom needs to be destroyed to cleanse the system. But King's plan is to allow those who received this phoney wealth to keep it (by protecting asset prices at all costs), while impoverishing the young and future generations.

He has failed, but given the political independence of his post, it wouldn't look good if the government were to sack him.superfrank wrote: I despair of the US, and our very own Bernanke, King, will resign before the end of the year IMO - he has failed by any measure.

But I hope Osbourne has the balls to say 'Enough is enough! If the Bank of England are unwilling to execute their responsibility to control inflation by raising interest rates, I'll take the power away from them and do it myself!'.

I do worry about gold. Generally, bubbles burst, and when this one bursts it could cause even greater damage than the sub-prime bubble...superfrank wrote:Gold is the ultimate reserve currency and has been for thousands of years.

Jeff

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

+1Ferru123 wrote:If the Bank of England are unwilling to execute their responsibility to control inflation by raising interest rates, I'll take the power away from them and do it myself!'.

-1!Ferru123 wrote:Generally, bubbles burst, and when this one bursts it could cause even greater damage than the sub-prime bubble...

Gold isn't in a bubble. It's just been revalued to it's market price after years undervaluation due to people believing that debt=wealth. It doesn't.

Undervaluation relative to what?

Surely gold has little intrinsic value; like a banknote, it's basically worth what people are willing to exchange for it.

Every day in the horse racing markets, you get horses that go up and up in price. Then often there will come a point where the balance of power shifts from the layer to the backer. The layers who had pushed the price up then panic to get out of their position and start putting in back orders, and the price collapses. Surely the same thing could happen on a much bigger scale with gold.

Jeff

Surely gold has little intrinsic value; like a banknote, it's basically worth what people are willing to exchange for it.

Every day in the horse racing markets, you get horses that go up and up in price. Then often there will come a point where the balance of power shifts from the layer to the backer. The layers who had pushed the price up then panic to get out of their position and start putting in back orders, and the price collapses. Surely the same thing could happen on a much bigger scale with gold.

Jeff

superfrank wrote: Gold isn't in a bubble. It's just been revalued to it's market price after years undervaluation.

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

As a store of wealth.Ferru123 wrote:Undervaluation relative to what?

You can't print gold or silver. It has a finite supply.

History tells us that all currency systems ultimately fail. This time will be no different.