http://www.tullettprebon.com/announceme ... 110526.pdfThe government’s deficit-reduction plan is critically dependant upon growth returning to pre-crisis levels, and a return to growth is essential anyway if the burden of wider (private as well as public) debt is not to prove too heavy for Britain to carry.

Government and opposition alike base their thinking on the assumption that, by one means or another, growth can be restored.

We see no reason whatever to assume this.

To focus on the deficit is to ignore the fact that the British economy had become debt dependant long before the financial crisis.

Together, private and public borrowing has averaged 11.2% of GDP since 2003.

Over the past decade, borrowing has driven up output in financial services (+123%), construction (+27%) and real estate (+26%), whilst lavish public spending has propelled expansion in health (+35%), education

(+27%) and public administration and defence (+22%).

Real output in all other industries is now 5% lower than it was ten years ago.

Between them, real estate, finance, health, education, construction and public administration are six

of Britain’s eight largest industries, and account for more than 58% of output. Yet the future

prospects for at least five of these six sectors are grim, because:

Public sector spending cuts are modest, but growth is now a thing of the past.

Net mortgage borrowing, critical to the real estate and construction sectors, has crashed, from £113bn in 2007-08 to a derisory £3bn last year.

The aggregate of private (mortgage and credit) borrowing has now turned negative.

UK Economy

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

The next budget will be interesting.

Will George Osbourne bite the bullet and say 'Sorry folks, our growth forecasts were wrong, so we'll have to go for much higher than planned budget cuts'? Or will he hope to ride things out and stick with the status quo until the next election? I know which my money is on...

Jeff

Will George Osbourne bite the bullet and say 'Sorry folks, our growth forecasts were wrong, so we'll have to go for much higher than planned budget cuts'? Or will he hope to ride things out and stick with the status quo until the next election? I know which my money is on...

Jeff

superfrank wrote:The government’s deficit-reduction plan is critically dependant upon growth returning to pre-crisis levels, and a return to growth is essential anyway if the burden of wider (private as well as public) debt is not to prove too heavy for Britain to carry.

Government and opposition alike base their thinking on the assumption that, by one means or another, growth can be restored.

As an aside, did you see this story about a UK council going to court in the US because someone had allegedly libelled a couple of their councillors?

http://www.bbc.co.uk/news/uk-england-tyne-13588284

It's largely because of that kind of wastefulness that we're in our current mess!

Jeff

http://www.bbc.co.uk/news/uk-england-tyne-13588284

It's largely because of that kind of wastefulness that we're in our current mess!

Jeff

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

Those kind of people live in a fantasy world of self-importance.

According to the Mail (http://www.dailymail.co.uk/news/article ... -hide.html), £250,000 was wasted on this nonsense.superfrank wrote:Those kind of people live in a fantasy world of self-importance.

That kind of money could buy a shelter for the homeless or a refuge for battered wives...

Jeff

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

Comment from another site...

The UK economy is easy to explain:

From 2002-ish to 2007-ish the personal sector spent 20 years of disposable income in 5 years.

They are now paying back the interest.

Meanwhile, in the public sector GB, in an effort to get people to vote for him probably went on the largest benefit spending spree ever in the developed world. In short, he tried to create a client state, assuring himself that the fianancial sector would generate enoguth cash to pay for it.

While in the private sector, mainly the financial sector, they went absolutely f-ing nuts.

The 'ooh the cuts are too much for the economy are total BS. The UK state is taking in ~51% of GDP and still running a 11% deficit F!F!S!!!.

These are figures from the Soviet Union in the mid to late 80s.

The UK economy will contract. No point denying it. The choices are are 1) Contract or 2) Implode a la Greece, Ireland + Portugal.

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

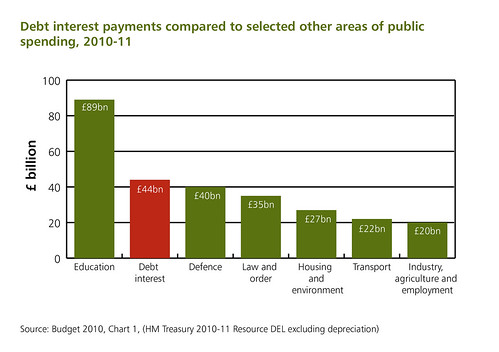

Or used to pay 0.0005814% of the UK's debt interest bill of £43bn for 2011.Ferru123 wrote:That kind of money could buy a shelter for the homeless or a refuge for battered wives...

Jeff

Last edited by superfrank on Mon Jun 06, 2011 1:30 pm, edited 2 times in total.

I agree 100%.

Public spending got us into this mess, and you don't cure a disease by applying the thing that caused it!

On another matter, you have to wonder what Vince Cable is playing at by threatening to bring in draconian laws if the unions take massive strike action. If you publicly threaten someone, it makes it harder for them to back down...

Jeff

Public spending got us into this mess, and you don't cure a disease by applying the thing that caused it!

On another matter, you have to wonder what Vince Cable is playing at by threatening to bring in draconian laws if the unions take massive strike action. If you publicly threaten someone, it makes it harder for them to back down...

Jeff

superfrank wrote:Comment from another site...

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

To be fair to VC he didn't threaten to bring in "draconian laws", he merely said that the "usual suspects" would call for tighter laws on TUs.

It's still quite surprising that he said it though - he must have known it would be taken as a veiled threat - maybe the govt. are seriously worried.

It's still quite surprising that he said it though - he must have known it would be taken as a veiled threat - maybe the govt. are seriously worried.

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

IMF says no changes are needed to UK economic policy

http://www.bbc.co.uk/news/business-13668574

The report's conclusions could have been (and probably were) written by Mervyn King. Why anyone listens to what the IMF has to say is beyond me.

IMO big changes are required to UK economic policy, but not the Plan B rubbish that is being talked about...

I'd start with cutting all public sector salaries over the national average by 25%. Immediately.

Cut the foreign aid budget by 50%. At least.

Sack Mervyn King and disband the MPC - sell the BoE building and ship the rest of them off to Milton Keynes.

Raise the base rate to 4% to protect the £ and hammer inflation.

Start a massive home building program in London and the South East (quality homes not Barratt slave boxes).

Declare everywhere outside the SE an enterprise zone and slash business taxes to encourage investment.

That would do for a start!

http://www.bbc.co.uk/news/business-13668574

The report's conclusions could have been (and probably were) written by Mervyn King. Why anyone listens to what the IMF has to say is beyond me.

IMO big changes are required to UK economic policy, but not the Plan B rubbish that is being talked about...

I'd start with cutting all public sector salaries over the national average by 25%. Immediately.

Cut the foreign aid budget by 50%. At least.

Sack Mervyn King and disband the MPC - sell the BoE building and ship the rest of them off to Milton Keynes.

Raise the base rate to 4% to protect the £ and hammer inflation.

Start a massive home building program in London and the South East (quality homes not Barratt slave boxes).

Declare everywhere outside the SE an enterprise zone and slash business taxes to encourage investment.

That would do for a start!

Last edited by superfrank on Mon Jun 06, 2011 2:05 pm, edited 2 times in total.

OK, maybe my wording could have been more precise.

But the message was clear - He effectively said 'If you take industrial action, my government will restrict your future ability to take such action'.

The fact that he played the good cop, and said that such decisions would be taken by others, will have done little to have dampen the impact IMHO.

Jeff

But the message was clear - He effectively said 'If you take industrial action, my government will restrict your future ability to take such action'.

The fact that he played the good cop, and said that such decisions would be taken by others, will have done little to have dampen the impact IMHO.

Jeff

superfrank wrote:To be fair to VC he didn't threaten to bring in "draconian laws", he merely said that the "usual suspects" would call for tighter laws on TUs.

It's still quite surprising that he said it though - he must have known it would be taken as a veiled threat - maybe the govt. are seriously worried.

Ed Balls is repeating his tired old mantra about the cuts being too soon and too deep.superfrank wrote:IMF says no changes are needed to UK economic policy

http://www.bbc.co.uk/news/business-13668574

Labour admit that, were they in power, they would have to make cuts. So why would their proposed level of cuts not throw the recovery (

Jeff

Perhaps someone can explain something to me.

Why are we borrowing significant sums of additional money when we're supposed to be bringing down public borrowing?

If I'm up to my eyeballs in debt, I'm not sure it would be wise for me to take out a new loan at the same rate of interest as my existing debt. If I want to reduce my overall debt burden, it seems a bit of an own goal...

Jeff

Why are we borrowing significant sums of additional money when we're supposed to be bringing down public borrowing?

If I'm up to my eyeballs in debt, I'm not sure it would be wise for me to take out a new loan at the same rate of interest as my existing debt. If I want to reduce my overall debt burden, it seems a bit of an own goal...

Jeff

superfrank wrote: