Trading can be as simple or as complicated as you want it to be and both approaches will work. Some people like as many conditions as possible to be ticked before they have the confidence to enter a market whereas others are happier to go with the flow. It'd be interesting to see which approach the longer term players use as I'd assume they'd be most likely in the less is more approach, that may well be down to them being able to filter out unneccessary conditions or simply greater confidence in what they do from experience and results.

Can a Simple strategy explianed in one sentence really work long term?

-

spreadbetting

- Posts: 3140

- Joined: Sun Jan 31, 2010 8:06 pm

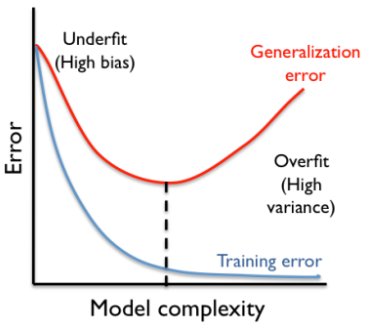

> if you make it too complex you are likely over fitting your data

That is so true - can't be emphasised enough.

As an 'old boy' from other types of market, I can comment from experience!

From my recent relatively short look at the last 6 years UK Horse Racing Win market data, it looks like there are some good, simple, long lasting fundamentals.

So to answer the original question - yes!

If simple is working, stick with it and don't worry about it until it stops working and you move on!

That is so true - can't be emphasised enough.

As an 'old boy' from other types of market, I can comment from experience!

From my recent relatively short look at the last 6 years UK Horse Racing Win market data, it looks like there are some good, simple, long lasting fundamentals.

So to answer the original question - yes!

If simple is working, stick with it and don't worry about it until it stops working and you move on!

- ruthlessimon

- Posts: 2094

- Joined: Wed Mar 23, 2016 3:54 pm

The irony is; "go with the flow" = too complicated to be explained objectivelyspreadbetting wrote: ↑Mon Jan 21, 2019 11:24 amSome people like as many conditions as possible to be ticked before they have the confidence to enter a market whereas others are happier to go with the flow.

& I'd personally define a strategy with several, (but objective) conditions, as being simple

- wearthefoxhat

- Posts: 3215

- Joined: Sun Feb 18, 2018 9:55 am

- ruthlessimon

- Posts: 2094

- Joined: Wed Mar 23, 2016 3:54 pm

Surely you're in a position to offer some insights too?spreadbetting wrote: ↑Mon Jan 21, 2019 11:24 amIt'd be interesting to see which approach the longer term players use as I'd assume they'd be most likely in the less is more approach, that may well be down to them being able to filter out unneccessary conditions or simply greater confidence in what they do from experience and results.

Well let's break down Peter's stance

"Cutting out biggest losses"

To me this means:

"What could I have objectively used to win on the race?"

Invariably meaning, raising the variable count (i.e. no longer simple) - as the current strategy obviously has some holes - & the biggest losers offer the best chance to spot some new variables. Now there's a super high chance those parameters are going to be wayy too refined - & that's why I personally spend hours & hours, looking to strip out what I can. But it has to be somewhat complex, or we fall back into the "nothing works, price is always efficient" argument.

But this is still very difficult, no question, & imo, a massive reason for failure. If I personally fail in the coming yrs, this'll be why. Not psychology, but what I spotted in the data had false weight. Someone could've the best dataset in the world, & still not spot the patterns/objective triggers.

Having to foresight & tenacity to spot genuinely predictive variables is very tricky - & this is where 1to1 mentorship benefits. This is also why people (on the face of it) can talk the talk; but not walk the walk - although it's easy to assume they are amazing traders behind the scenes.

My actual strategy in one sentence, sure.

My lessons (as distinct from strategy) I will share and are spread over several sentences:

My lessons (as distinct from strategy) I will share and are spread over several sentences:

- don't pick up pennies in front of the steamroller - for me I wouldn't pick up 1 tick moves or scalp and then let my loss be open ended and my position drift off into a massive loss because I didn't get that one tick, quickly hack off your arm before your entire body is crushed

- accept losses (even the occasional big loss and don't try to win it back, just go back to doing what works and put the loss down to a learning exercise)

- keep records of days, carnivals, individual races from year to year and go back over those records when you approach the same day, carnival, race the next year

- write down what you learn and go back and re-write those notes

- watch this https://www.youtube.com/watch?v=ktlTxC4QG8g

- ruthlessimon

- Posts: 2094

- Joined: Wed Mar 23, 2016 3:54 pm

If that counts

; then: -

; then: -

"Steams have volume"

"Steams have volume"

- ShaunWhite

- Posts: 9731

- Joined: Sat Sep 03, 2016 3:42 am

Depending on your available time ....

Short version : How would you define that in a glossary?

Long version: You've used this phrase several times before and I wonder if you could expand on what you're meaning by that? I've only ever come across the term from the derivative trading playbook, specifically options. I can see how sports markets might be analogous to futures as they have an exercise price which approaches the underlying asset value (ie bsp) but I'm struggling to take the similarity any further, certainly not as far as options. Last time I looked I couldn't lapse a bet, only trade out of it, or exercise it (ie let it run). And where's the asset to hedge against, or intrinsic value?

Do you perhaps mean it's movement your looking for and as backs are easier to get out of, that side first is preferable. Or is the answer is maybe between the two ?

Sorry to sound so baffled but if I'm struggling to understand (and that's having designed derivative strading systems for years

Philosophy aside, if you can precisely and easily explain your edge then you should be moving in the right direction if you ask me. I have found that edges and concepts are usually very simple, it's the (proper) execution that is the complicated part.