Hi all,

In this video (https://m.youtube.com/watch?v=_TKeoraX_YU) Peter talks about a trend having lower highs. Is that a good indicator that the trend will continue?

It’s also great to hear that Peter still gets excited when the market goes in his direction!

Thanks

Trend following indicator

- firlandsfarm

- Posts: 2720

- Joined: Sat May 03, 2014 8:20 am

No indicator will 100% confirm a trend will continue into the future, it's a mix of indicators and personal interpretation.Rob51852 wrote: ↑Thu Jan 23, 2020 4:11 pmHi all,

In this video (https://m.youtube.com/watch?v=_TKeoraX_YU) Peter talks about a trend having lower highs. Is that a good indicator that the trend will continue?

It’s also great to hear that Peter still gets excited when the market goes in his direction!

Thanks

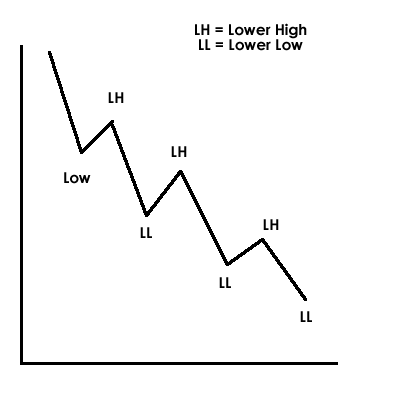

Lower highs is a definition for a down trend and conversely higher lows would be an up trend. Some use a slightly different definition of lower lows for a down trend and higher highs for an up trend. I think the reason for the difference may be that higher lows means the price must be moving up but the highs could be flat and therefore limited profit whereas higher highs means you have the opportunity to maximise profit on a higher high but could also make a loss if the lows are not higher! Perhaps a mix of the two is best.

There are many vids and pages on the Internet about trends in stocks and forex (here is one about trends https://www.youtube.com/watch?v=j0D9LIH7hGw). Don't worry about the timeframes they refer to, the main difference between sports trading and financials is that in sports trading you have a time limited market and you know that at the end of that time period the price will either be 1.01 or 1000.00 whereas with financials the market is theoretically never ending and the price has no ceiling and the only floor is zero if the stock goes bust! You still get trends to follow in sports trading and you will see you also get 'pull-backs'. A popular ploy in financials trading is to trade the pull-backs i.e. when the price dips back you buy/back at a small discount and ride what you hope will be the following rise with the trend (and short/lay the reverse). The trick is to identify a pull-back from a reversal. There is no hard and fast formula. A pull-back is usually a price move by profit taking following a price rise so once traders have taken their profit the price rise continues whereas a reversal is where something causes a reassessment of the price opposite to the current trend. The most obvious place to see a reversal is in-play football. Until a goal is scored the prices for both teams will trend up and the draw will trend down but as soon as a goal to the detriment of one team the other team's price will see an immediate reversal.

But there are many more active and more successful traders than me in this forum.

-

Archery1969

- Posts: 3217

- Joined: Thu Oct 24, 2019 8:25 am

- Location: Newport

I dont think the mad bomber use to worry about Trends, Lower highs or higher lows.

If someone wants to dump a large lump of money into the market to force the price down or up and your on the wrong end of it then you will get steam rollered very quickly.

If someone wants to dump a large lump of money into the market to force the price down or up and your on the wrong end of it then you will get steam rollered very quickly.

You wont get steam rollered if you're managing your exposure correctly, itll hurt in that moment but for each time the bomber hits you there is the same chance you could be on the other side and it goes for you.Archery1969 wrote: ↑Fri Jan 24, 2020 12:19 pmI dont think the mad bomber use to worry about Trends, Lower highs or higher lows.

If someone wants to dump a large lump of money into the market to force the price down or up and your on the wrong end of it then you will get steam rollered very quickly.

- firlandsfarm

- Posts: 2720

- Joined: Sat May 03, 2014 8:20 am

Agreed but the OP was asking about trends and once that large sum has been swallowed up or taken out having done it's job the market will revert back to 'normal'.Archery1969 wrote: ↑Fri Jan 24, 2020 12:19 pmI dont think the mad bomber use to worry about Trends, Lower highs or higher lows.

If someone wants to dump a large lump of money into the market to force the price down or up and your on the wrong end of it then you will get steam rollered very quickly.

Well if you wanted to simplify it, a downtrend is usually just a series of lower lows and lower highs, like in the illustration below, and vice versa. I have found it important to learn to use a bit of technical analysis in order to better trade speculative markets, but only up to a certain point before hitting severe diminishing returns (if you start actively measuring graphs looking for patterns like head and shoulders I think you've gone too farRob51852 wrote: ↑Thu Jan 23, 2020 4:11 pmHi all,

In this video (https://m.youtube.com/watch?v=_TKeoraX_YU) Peter talks about a trend having lower highs. Is that a good indicator that the trend will continue?

Where I feel people often go wrong in speculative markets like prerace is they try to watch the order flow very carefully which often leads to them getting caught up in the market noise and then it's very easy to lose sight of the bigger picture and the bigger trend. By all means observe the order flow, but be wary of tunnel vision.

In my opinion the most effective way to trade a speculative market in general would be to take up a value position as early as possible and then just sit on it for as long as possible, although that's easier said than done, spotting great value positions is usually the easier part but I have found that patiently sitting on them is remarkably difficult, it's a very hard skill to develop but that's how it should be because that's the endgame skill that every trader wants to learn eventually. Like the great Jesse Livermore often said : "Men who can both be right and sit tight are uncommon."

Maybe you can think of a trend like a running train, once it gets going it can't really stop in the middle of nowhere, it sort of has to stop at the next train station (next round number and next important price point), so if it stops there temporarily but still keeps going then it's likely that he'll keep going until the next train station and so on. The sheer speed of it can sometimes give you a bit of a hint of how far it can generally go, before turning back, and sometimes due to great momentum and human greed it's very difficult to stop so it often goes further than it should.

That's why I think it's a bit suicidal to step in front of a steaming train in the middle of nowhere as it can easily smash through you, it makes much more sense to wait for the train to actually stop before you board it yourself for the trip back or wherever you want to go.

Hopefully that made some sense.

-

teambulldog

- Posts: 116

- Joined: Wed Jan 04, 2012 9:09 pm

Very well laid out Kai,,,

Great words and thanks for taking the time to explain

Julian

Great words and thanks for taking the time to explain

Julian

-

smallplayer

- Posts: 120

- Joined: Wed Aug 17, 2016 8:30 am

nice analogy kaiKai wrote: ↑Fri Jan 24, 2020 2:35 pmWell if you wanted to simplify it, a downtrend is usually just a series of lower lows and lower highs, like in the illustration below, and vice versa. I have found it important to learn to use a bit of technical analysis in order to better trade speculative markets, but only up to a certain point before hitting severe diminishing returns (if you start actively measuring graphs looking for patterns like head and shoulders I think you've gone too farRob51852 wrote: ↑Thu Jan 23, 2020 4:11 pmHi all,

In this video (https://m.youtube.com/watch?v=_TKeoraX_YU) Peter talks about a trend having lower highs. Is that a good indicator that the trend will continue?), and I think it's very helpful to try and identify the long-term trend. I think in a nutshell one of your main jobs as a trader is to use the order flow to work out whether a move is just a temporary retracement or a full blown reversal of the trend.

Where I feel people often go wrong in speculative markets like prerace is they try to watch the order flow very carefully which often leads to them getting caught up in the market noise and then it's very easy to lose sight of the bigger picture and the bigger trend. By all means observe the order flow, but be wary of tunnel vision.

In my opinion the most effective way to trade a speculative market in general would be to take up a value position as early as possible and then just sit on it for as long as possible, although that's easier said than done, spotting great value positions is usually the easier part but I have found that patiently sitting on them is remarkably difficult, it's a very hard skill to develop but that's how it should be because that's the endgame skill that every trader wants to learn eventually. Like the great Jesse Livermore often said : "Men who can both be right and sit tight are uncommon."

Maybe you can think of a trend like a running train, once it gets going it can't really stop in the middle of nowhere, it sort of has to stop at the next train station (next round number and next important price point), so if it stops there temporarily but still keeps going then it's likely that he'll keep going until the next train station and so on. The sheer speed of it can sometimes give you a bit of a hint of how far it can generally go, before turning back, and sometimes due to great momentum and human greed it's very difficult to stop so it often goes further than it should.

That's why I think it's a bit suicidal to step in front of a steaming train in the middle of nowhere as it can easily smash through you, it makes much more sense to wait for the train to actually stop before you board it yourself for the trip back or wherever you want to go.

Hopefully that made some sense.