How the bookmakers get you…

If you’re looking at a betting market, the only way that you can make money in the longer term is by backing at odds that are above the implied chance of that particular event occurring. If you can back a football team that has a 50% chance of winning but the bookmakers give you odds that represent value above that (In this case decimal odds of 2.00), you WILL make money in the long term.

The way that bookmakers make money is by offering the odds that just don’t represent value or the true chance of something happening. In order to understand that properly, you need to understand what the odds mean.

Keeping ahead of bookies by using value betting

We’re going to explain how to take fractional odds, convert them to decimal odds and then convert that to implied chance. This will allow you to understand exactly what value is or isn’t being created when you place a bet.

The problem that most people have when they place a bet is they’re just placing a bet to win. All that they do is stick a tenner on something because they think it’s going to win, there is no concept of value in there whatsoever. But by understanding how odds are made, you will get to understand the value and therefore you will be able to place more sensible bets.

Firstly, we need to understand how odds are constructed. Let’s imagine you enter into a market and you see odds quoted at 9/4 for a football match for example.

You put place a bet for £10 at 9/4, but what does that mean and what do those odds give you…?

Fractional odds and decimal odds: how they help you become a smarter gambler

When you’re looking at fractional odds you’re looking at a ratio…

9/4 = £9 won if you bet £4

That’s the easiest way to understand fractional odds, for every £4 you put down you will win a sum of £9 back. Effectively what you’re looking at with fractional odds is a ratio, so if I do 9 divided by 4 – it gives a ratio of 2.25 times your stake and this will be your return.

So if you put £100 down you’ll get 2.25 times back what you originally staked.

So you can see that what you’re viewing when you’re looking at fractional odds is a ratio. All odds are ratios based upon how much the bookmaker is willing to pay you based upon the stake that you give him.

Converting decimal odds from bookmakers fractional odds

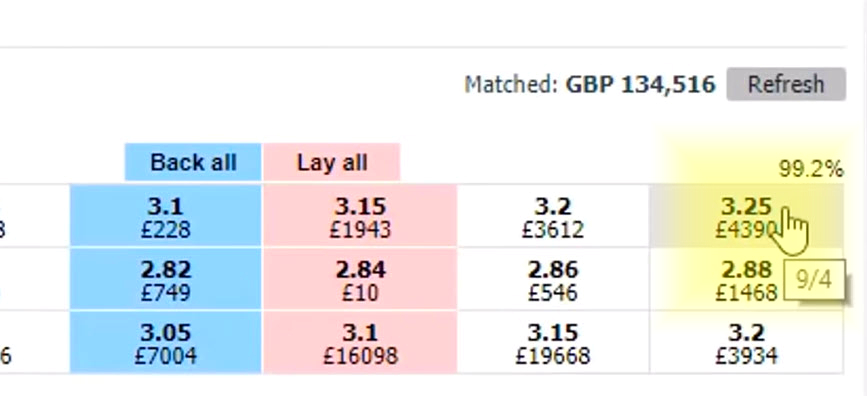

When you look at a betting exchange they tend to not use fractional odds. However, they do very often give you a comparison of fractional odds so you can do a direct comparison between fractional and decimal. An example of this is shown in the image above where hovering your mouse over the decimal odds allows you to see the fractional odds.

But it is the process of converting a fractional odds to a decimal and then into an implied chance, that gives you the edge the understanding values better then what the bookmaker gives you…

Implied chance is the thing that betting tipsters rarely talk about. But it’s the very thing that you need to know to get an edge at betting.

So if we look back at our odds of 9/4 where we divided it by four (which we did to understand our return stake) we get 2.25. However, now we need to convert this 2.25 ratio into decimal odds. To get our decimal odd, all we need to do is add one, 2.25 now becomes 3.25. So if you go on to the exchange that you’re going to use and you see odds of 3.25 that is odds of 9/4 (refer to the earlier image which displays this on Betfair.)

But what does that actually mean?

If we saw a football team price priced at 3.25, is that value or not?

Spotting betting value

If we look at decimal odds of 3.25 I can do a simple calculation to understand what value is present in a bet. If I do 1 divided by 3.25 that comes out at 0.3077 this new number we calculated is actually a percentage. 3.25 = 30.77% chance of this event occurring.

By dividing these odds by 1, it gives you a percentage, but it also works the other way. 1 divided by a percentage will give you the odds.

So if we’re going to place a back bet at odds of 3.25 we’re saying that we think the thing where we’re backing has a 30.77% chance of winning.

Getting an edge over the bookie – create your own model

The odds show us that our selection is being priced with a 30.77% chance of winning. Let us say that that we think that it’s got a 40% chance of winning. If we divide 1 by 0.4 it equals 2.50.

What we’re saying is we think the chance of this event occurring is 40% which would mean that we’re willing to accept odds down to 2.5. Any odds below 2.5 it becomes a lay bet, if the odds are above 2.5 then it becomes a back bet. Why is that?

Well if we think it’s got a 40% chance of winning, so we’ve assessed what has been happening in similar markets and the recent history of the event beforehand. After religiously looking through all the stats and maths we’ve come up to the conclusion that there’s a 40% chance of this happening. When you are gambling, this is the key information you need. When you look at betting tips, what you really need is not a betting tip, but the chance of something happening.

However, the bookmaker thinks there’s only a 30% chance. So if we do a calculation (40% – that 30.77%) that comes to +9.23% That means that actually, we effectively have a 9% edge here if our model is correct.

If our theory is correct and we think it’s got a 40% chance of winning. The bookmaker has got it wrong at 30%, giving us a margin. If we can back at 3.25 when we think its true odds should be at 2.50, over the very long term we are going to make money there.

When to notice if your model is telling you to lay or back a bet

In contrast, let’s change these odds and see what happens. If we say we’re now looking at 5/4 instead of 9/4. We first go through the same process, so if I do 5 divided by 4 and then we add one to it the ratio and the decimal odd comes out it’s 2.25.

1 / 2.25 = 0.4444 x 100 = 44.44%

So this is now saying that the market thinks there’s a 44% chance of this particular event occurring this person or this team winning whatever the market you’re looking at.

Yet earlier we said we personally think there’s a 40% chance and it’s 2.25. When calculating this against what the bookmaker is currently saying against are prediction it puts us behind at -4.44%. So we think it’s got a 40% chance of winning which equals to 2.50. We’re willing to back if we get odds at 2.50 or greater. If something is at 5/4 the market is offering it to us at 2.25. It’s below our threshold there’s no reason that we should place the back bet in this market.

In fact, rather than a back bet, you may even want to consider placing a lay bet in this particular market because the odds are just no good here. So the thing you’d have to say is that 4% margin I confident enough that I think that my model is accurate enough, that I know that I’ve got a 4% edge in this particular market, in which case you would lay.

Creating value by using a betting exchange

When you go into a market, you’re saying you ‘know’ that if Manchester United are playing a certain team and if they played them 10 times, they would win four of those games. That’s where your 40% is coming from. If you can come up with the reason why that is definitely going to happen, given all of the circumstances that have and could happen, then that would be how you come up with that 40% figure. You can then convert that 40% figure into odds and then see if those odds are available.

The great thing about using a betting exchange is even if those odds are not available, you can ask for them. You can put those odds into the market for somebody else to match. It’s the ultimate way to ‘create’ value.

Creating value by placing a value bet is ultimately is a great way to get an edge, but ultimately any bet placed at value will profit in the long term.