Stop Loss & Trailing Stop Orders

If you use offsetting it is possible for the market to move against your position. This means a loss is almost a certainty. If you let the loss run it could get much bigger and therefore stop orders can be applied to any offset orders you put in the market. The stop order works by closing your position at the best available price at the moment the stop fires. It is designed to allow you to exit the market immediately and without emotion. Stop orders will fire if you use them before the off and in-play. Due to the way exchanges work it is not possible to carry stop orders between the pre-off and in-play transition.

Stops can be in the form of ticks or percentages but will be the same as you have chosen to use for your offsets.

Its not possible to use ticks for your offset and a percentage for a stop!

Pro Tip: When you start trading discipline is key as is controlled emotion. Stops can close a position and prevent you from taking a chance on a position.

If you enter the market by backing at 2.66 and you arm the stop at 2 ticks. The stop will trigger if your subsequent lay order breaches 2.70. Because you have backed first it will place a lay order to close your position.

Place stop at

The ‘place at (ticks or %)’ function has been designed to ensure that the stop orders fires at a reasonable price. If a stop fires it will try to close your position at the best available price. It is possible a large order may have pushed the price straight through your stop odds of 2.70 thus leaving your stop order as a unmatched bet requiring the price to come back down for it to be matched.

By triggering your stop at a number of ticks or percentage and using a higher number to place it at you increase the chance's of your stop being matched.

Following on from the previous example, if the stop is triggered at 2.70 the software now places a stop lay order at 2.76 (3 ticks higher). By placing the lay order at this kind of level it virtually assures the closing position is completed, even if a large order arrives in the market taking the price straight past the initial trigger odds of 2.70.

It works the same way when using percentages, by placing your stop slightly higher than its triggered you will increase your chances of the stop being successfully matched.

Note; There is never ANY guarantee a stop will be matched especially on volatile markets like in-running horse racing where the odds fly around all over the place.

Trailing stop

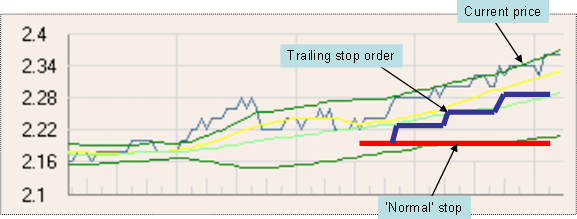

If you are looking to catch broader trend in a market but want to retain a stop loss you can use the trailing stop. This would not be suitable in a scalping market because as mentioned you are looking at a larger market move. The trailing stop is flexible as opposed to fixed. The basic idea is for the market to move in your favour and for the trailing stop to literally trail behind your position. For example, the market move two ticks in your favour so the stop moves up two ticks and trails your position or the market moves 5% in your favour the stop also moves up 5% trailing behind your position but ready to stop you out should the direction suddenly reverse. The following illustration demonstrates how a trailing stop order moves.

The red line represents a conventional stop order it is fixed according to your chosen offset. This stop never moves which means a quick drop back in the market caused by a large order spike could trigger your stop with a loss being the only outcome! Pro Tip: Using a stop is good as you learn discipline but in volatile markets it can often result in stop orders closing your position multiple times with a loss on each one. As you progress you will realise unless you are scalping a stationary market, it is vital to place your stop offset more than 1 tick away from the current market position or you will get unwanted stop orders firing and matching. Remember, the trailing stop is for markets where more movement is anticipated.

If you use a trailing stop as represented by the blue line, you will see it is pulled up behind your order to ensure there is a greater chance you will move into a profitable situation and a guaranteed one too! If the trend fails and starts to retrace, Bet Angel will close your order. In a strong trending market it is likely that your trailing stop will have moved some distance and therefore you catch the predicted long term trend in price movement. But if that trend reverses and ends your trailing stop will cut you out immediately locking in your profit.

Simple example: Lay order placed at 2.16 with an offset trailing stop of 5 ticks. As the market rises the stop pulls up and trails your position. If the market moves 5 ticks in your favour to 2.26 you cannot make a loss on the position as the stop is now sitting at 2.16 which was your opening position. If it moves further in your favour than a profit will be realised and only if the market then drops back 5 ticks will Bet Angel close your position with the stop order.

Example

To see some examples of using stop loss orders on both the ladder and one-click trading screens see this thread from our forum.

Video Tutorial