Probably wont impress the doom mongers buy hey ho

Buffett Says ‘Bet Heavily' Against Double Recession

For America to recover, it needs growth. It's hard to see where that growth is going to come from.

IMHO, this article sums up nicely the situation the West is facing: http://www.bbc.co.uk/news/business-14154505

Jeff

IMHO, this article sums up nicely the situation the West is facing: http://www.bbc.co.uk/news/business-14154505

Jeff

That's where people go wrong though Jeff, people look in the rear view mirror too often. Capitalism is all about overcoming issues, not worrying about them.

I read the following many years ago and it was one of the things that helped me form some very clear opinions on the financial markets. Worth a read and it will only take a minute or two!

http://www.dryassociates.com/images/maxims.pdf

I read the following many years ago and it was one of the things that helped me form some very clear opinions on the financial markets. Worth a read and it will only take a minute or two!

http://www.dryassociates.com/images/maxims.pdf

Whilst no-one knows what the future holds, surely it's possible to make an educated guess about what might be to come, based on what's already happened.Euler wrote:That's where people go wrong though Jeff, people look in the rear view mirror too often.

Granted, but as the current situation with the Premium Charge shows, there are limits to what the free market can achieve...Euler wrote:Capitalism is all about overcoming issues, not worrying about them.

Unless something unpredictable happens, the future looks pretty grim for the West.

Nice link!Euler wrote:http://www.dryassociates.com/images/maxims.pdf

Jeff

People worry too much about what could go wrong without thinking about what could go right. That was the same mistake I made when I was young, seeing the problems rather than opportunites. Opportunties and issues are created in equal proportion, never forget that.Ferru123 wrote:Whilst no-one knows what the future holds, surely it's possible to make an educated guess about what might be to come, based on what's already happened.

The Internet wasn't on any analyst report I read twenty years ago, but look at the massive impact it has had on the world today. Just imagine what will come along in the next twenty years.

True - and at the other end of the scale, humans are also good at creating bubbles by jumping onto bandwagons!Euler wrote: People worry too much about what could go wrong without thinking about what could go right.

True.Euler wrote:The Internet wasn't on any analyst report I read twenty years ago

I wish I'd thought about the potentials the internet offered when I first went online in 1993, and Ebay hadn't even been founded! I still remember my first email address - [email protected] (which wasn't a Bond reference, btw - I was just the 7th sociology undergraduate at Lancaster to get an email account!). But I digress - this kind of 'what if' thinking drives you insane!

But it's hard to see what could come along to completely change the game for the world economy, unless perhaps a physicist finds a way of creating energy extremely cheaply by nuclear fusion...

Jeff

When I was working for Compaq in the early 90's I was the first person to get an internet address and that was thanks to my experiance on compuserve who implemented an internet gateway. Prior to Compuserve I used Prestel which was owned by BT, but they closed it down and transfered me to Compuserve as they said they couldn't see a future for online services.

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

I know Buffet is feted as an investment god, but the fact remains that, without the FED, he, and Berkshire Hathaway, would have lost loads.

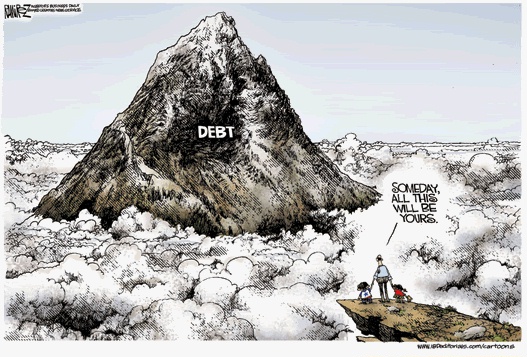

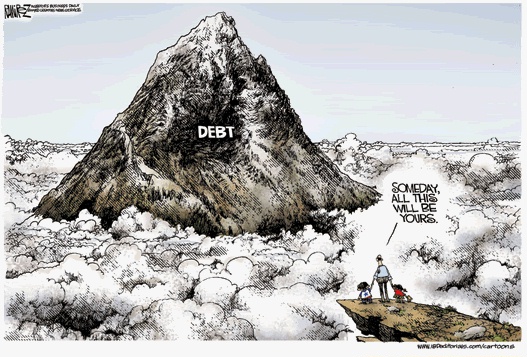

Every time there's a problem (dotcom bust, 9/11, whatever we call the current mess) they come along to prop it up by borrowing more and more from the future.

Every time there's a problem (dotcom bust, 9/11, whatever we call the current mess) they come along to prop it up by borrowing more and more from the future.

Last edited by superfrank on Sat Jul 16, 2011 9:33 am, edited 4 times in total.

-

elcapitain

- Posts: 45

- Joined: Tue Feb 22, 2011 4:01 pm

I think we are headed to a new paradigm shift with regards to fiat money, the 30 year experiment is coming to an end.

If we are going to see an economic recovery, we need a new productive capacity (like the internet was). Hopefully it will be something along the lines of zero-point energy or something else that will revolutionise our lifes.

Cap.

If we are going to see an economic recovery, we need a new productive capacity (like the internet was). Hopefully it will be something along the lines of zero-point energy or something else that will revolutionise our lifes.

Cap.

-

andyfuller

- Posts: 4619

- Joined: Wed Mar 25, 2009 12:23 pm

BBC wrote:Billionaire Warren Buffett's investment firm Berkshire Hathaway has reported a sharp rise in profits thanks in part to strong returns on derivative contracts.

Net profits for the second quarter were $3.4bn (£2.1bn), a rise of 74% on the $2bn the company made a year earlier. Revenue grew to $38.3bn.

The profits on derivatives helped offset insurance losses.

Mr Buffett is the world's third richest man, with an estimated fortune of about $50bn, according to Forbes.

Berkshire Hathaway has sustained losses at its insurance businesses this year owing to the natural disasters in Japan and New Zealand.

http://www.bbc.co.uk/news/business-14428407

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

Buffet once described derivatives as "weapons of mass destruction"...

http://www.investopedia.com/articles/op ... z1UGF33pq2

Buffett to FBN: S&P Downgrade 'Doesn't Make Sense'

http://www.foxbusiness.com/markets/2011 ... ake-sense/

His argument is that as long as the US can print it's debts away then AAA should be maintained. I think he's losing it. I'm glad I didn't bet heavily against a double dip!!

http://www.investopedia.com/articles/op ... z1UGF33pq2

Buffett to FBN: S&P Downgrade 'Doesn't Make Sense'

http://www.foxbusiness.com/markets/2011 ... ake-sense/

His argument is that as long as the US can print it's debts away then AAA should be maintained. I think he's losing it. I'm glad I didn't bet heavily against a double dip!!

Berkshire Hathaway's outlook has been downgraded by S&P: http://www.reuters.com/article/2011/08/ ... 5K20110808

Jeff

Jeff

- superfrank

- Posts: 2762

- Joined: Fri Aug 14, 2009 8:28 pm

Warren Buffett calls for higher taxes for US super rich

http://www.guardian.co.uk/business/2011 ... super-rich

The US is a kleptocracy where the super rich control the political show to ensure that only the working and middle classes pay tax.

http://www.guardian.co.uk/business/2011 ... super-rich

The US is a kleptocracy where the super rich control the political show to ensure that only the working and middle classes pay tax.