Twenty-Five Years on Betfair

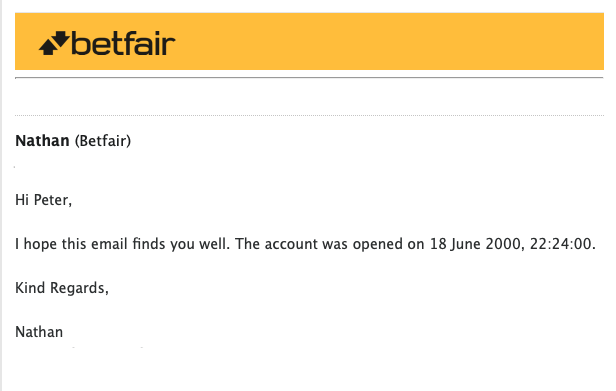

On 18 June 2000, not long after Betfair had opened its virtual doors, I clicked “open account”, placed my first trade and wrote the opening line of a story that would change my life.

Twenty-five years later I’m still here, still learning, and still humbled by what this unique marketplace makes possible.

Today I’d like to mark the milestone, share a few reflections, and—above all—encourage anyone who’s just starting out to keep going.

If a chap with a mortgage, a supportive (but understandably cautious) wife and three young children could make it work, so can you.

The day I became an early adopter

Back in 2000, Betfair itself was barely out of beta. Andrew Black and Ed Wray had only founded the exchange that same June, intent on disrupting a centuries-old industry by letting punters bet against each other rather than against the bookmaker.

To most people the concept sounded borderline crazy; but to me—fresh from doing lots of work on the Internet in financial markets—it looked wonderfully familiar.

Depth, price discovery, order flow: it felt like the City, only with a soundtrack of cheering crowds instead of ringing phones. Being one of the first through the door gave me a head start that I’ve never taken for granted.

Inventing my own tools: the birth of Bet Angel

The early Betfair platform was revolutionary, but it wasn’t built for the sort of rapid-fire trading I wanted to do.

So in 2004, before Betfair had even released an API, I commissioned the first version of Bet Angel—software designed to automate the dull bits, surface data at speed and free me to think instead of click.

What began as a personal side-project soon found an audience of other traders, and Bet Angel has been evolving ever since. Creating it was less a stroke of genius than a necessity: if the kit you need doesn’t exist, build it.

Going full-time with real-world responsibilities

Leaving a comfortable job to trade for a living is scary; doing it with a young family is scarier. I won’t pretend otherwise.

Yet in 2003, I took the plunge, armed with meticulous records, stringent risk controls and the blessing of my wife, I went for it.

Those early months were intense, but the discipline of protecting their future as well as mine forced me to become super focused.

Within about six months, more opportunities opened up, things I’d never thought about, and I knew I’d made the right choice.

Getting to the magic million

I learnt that consistency was key, and while I loved to get some big results, it was often more about being disciplined and grinding out results.

I seemed to average around £20-30 a market. £100k was my initial target, a target that would ‘proved’ what I was doing was working and I soon hit that mark.

But then I started to ponder what I needed to do to hit the magic million. There were roughly 15,000 races a year, and with other sports I could push that number higher. So I did.

It took me roughly 47,000 markets to reach the magic million, and rather than celebrate that, I just never stopped…..

Pushing the limits

Over the two decades that followed my decision to go full-time I averaged over £1 million a week in bets. That headline number is eye-catching, but it hides the real lesson: turnover ≠ profit.

Margins in exchange trading are thin, so longevity depends on compounding small edges, controlling costs and never underestimating variance. If the figure proves anything, it’s that consistency beats bravado.

The exchange mechanism helps as well. Being able to get in and out of the market at little cost, means you can take lots of positions in the hope of a profit, but exit them easily if it’s not working out.

Also, there are so many markets. On any one day you can have 10,000’s of markets to choose from, to find an niche, an edge.

From half a trillion to one trillion—and counting

By 2017 publicly available Betfair data already recorded nearly half a trillion pounds in matched bets. That total has now surged past the £1 trillion mark, a testament to the exchange’s resilience and the appetite for peer-to-peer markets worldwide. Watching that snowball grow—knowing I was there from the first flakes—has been equal parts thrilling and humbling.

Some things never change

While my journey has been remarkable, I think it’s more remarktable that the old-fashioned betting industry is still around. Perhaps driven by margins rather than opportunity, the reasons I stopped betting in the first place, restrictions, limits and lack of scale, still seem to plague people who don’t seem to be able to make the jump to exchanges.

You also see that people who exploit peoples desire to profit from betting also appeared in trading circles.

I guess some things never change!

The road ahead: opportunities for the next generation

Twenty-five years on, I’m still excited each time I boot up Bet Angel and see a fresh market form.

Edges evolve, regulations shift and technology races ahead, but the core principles stay the same: understand risk, think probabilistically, and keep meticulous records. Any edge on a large number, becomes a large number itself.

Whether you trade for a hobby or aspire to professional status, the exchange still offers opportunities my younger self could scarcely imagine.

I would never have guessed that in the 2025 Grand National I would make just short of £3k fully hedged, or win on all 28 races at Cheltenham and still have not lost on The Derby. I just wouldn’t have believed that back when I started.

Thank you to everyone who’s shared the journey—family, fellow traders, Bet Angel users, and the wider Betfair community. Here’s to the next chapter, wherever it takes us.