How to Find an Edge That Lasts

Understanding value is the foundation of every successful strategy on Betfair. Whether you’re placing a straight bet or trading in and out of a market, the same principle applies: you need to know when the odds are in your favour. Without that, everything else becomes noise.

Below is a clearer, updated look at what value betting really means, how it applies to trading, and how to start using it to widen your edge.

What Value Betting Really Means

Most people think value betting is simply finding a big price or spotting something the market has “missed”. In reality, value only exists when your estimated probability is better than the odds being offered.

If you believe a horse has a 50% chance of winning, the fair price is 2.00. If you can back it at 2.20, you have value. If you lay it at 1.80, you have value. Everything flows from that core idea.

The outcome of a single bet doesn’t confirm whether you found value. Only the long-term results do. That’s why so many people struggle with the concept—value betting rewards good judgement, not short-term luck.

Why Value Matters for Betfair Trading

Trading isn’t just about reacting to moves on the ladder. It’s still about value, just on shorter timeframes.

If you open a position because you believe the price should be lower or higher, you’re effectively trading value. The market might not agree instantly, but if your reasoning is sound, the price usually drifts towards the “correct” range. This is what produces consistent trading profits.

Many new traders make the same mistake: they look at charts, patterns or momentum without asking the essential question—am I opening this position because the price is wrong?

Once you start thinking in terms of value, your trading becomes far more structured. You avoid random entries and focus on opportunities where the odds are misaligned with the likely outcome.

The Two Ways Value Appears on Betfair

Value tends to appear in two broad forms:

1. Market Mispricing

Sometimes the price is simply out of line with the real probability. This can be due to overreaction, emotion, recency bias, or the market placing too much emphasis on a single factor.

2. Market Movement

Other times, the current price is correct now, but you know it won’t stay correct. Markets often move predictably before major points in the lifecycle—team line-ups, going changes, late money, or when liquidity floods in close to the off.

Both situations create value, but they require different skills. The first relies on analysis; the second on experience and reading the flow of money.

Why So Many People Miss Value

Most punters focus on outcomes rather than the quality of their decisions. A loser is assumed to be a bad bet, and a winner is assumed to be a good one. This way of thinking prevents people from ever identifying genuine value.

Value betting demands that you:

- think in probabilities, not certainties

- accept losing runs without losing faith

- understand that good bets can lose

- judge decisions, not outcomes

Once you make this shift, betting becomes far more predictable and trading becomes far more controlled.

Using Betfair Data to Improve Your Value Judgement

Betfair offers a direct view of real-time supply and demand. Instead of relying on traditional bookmaker prices, you can see where money is being matched, where it’s queueing, and how the price reacts to volume.

Useful indicators include:

- stalled moves showing resistance

- sudden spikes caused by overreaction

- trading ranges forming around fair value

- pre-off pressure building in predictable patterns

When combined with your own understanding of the market, this information helps you sharpen your value estimates and pick better entry and exit points.

Value Betting vs Trading: Which Is Better?

They’re not opposites—they’re built on the same foundation. The difference is timeframe and intent:

- Value betting seeks long-term profit from mispriced odds.

- Trading seeks profit from short-term price adjustments.

In both cases, you’re only profitable when you get value. Trading just gives you more control, because you can close your position when the market corrects.

For that reason, many people find trading psychologically easier than pure value betting. You aren’t waiting for the final result—you’re exploiting the market’s behaviour.

Developing a Value-Driven Approach

If you want to improve your Betfair performance, start by building value into your thinking every time you open a position. That means:

- understanding the market

- recognising when prices are justified

- spotting inefficiencies

- thinking ahead rather than reacting

- using data objectively rather than emotionally

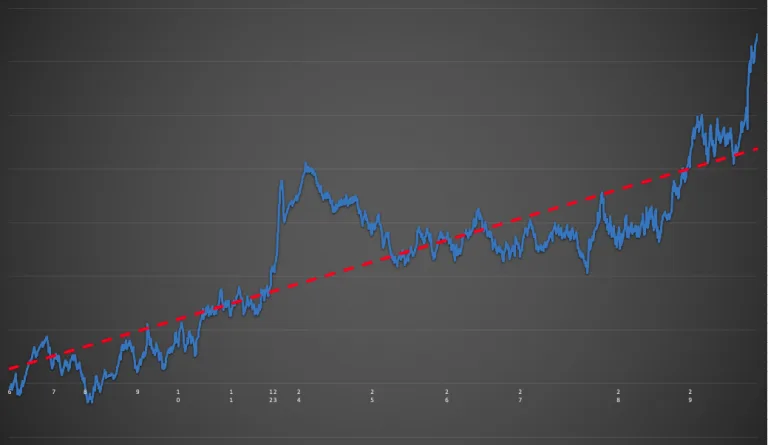

The better you get at estimating probabilities, the more the markets open up for you. Over thousands of trades and bets, even a small value edge compounds into significant profit.

Final Thoughts

Value betting isn’t a trick, a system, or a shortcut. It’s the core mechanic that underpins every successful bettor and trader. Once you understand how value works and apply it consistently, the market becomes far less chaotic and far more predictable.

Betfair rewards the people who think in probabilities, understand mispricing, and act when others hesitate. If you want long-term success in betting or trading, value is where everything starts.