Best Execution on the Betfair Exchange

Getting matched at the best available odds is one of the major advantages of trading on the Betfair Exchange, yet many bettors misunderstand how Betfair’s best execution actually works – and how to harness it inside software such as Bet Angel.

This post demystifies the mechanics, shows where the edge lies, and offers actionable tips to squeeze every tick of value from the market.

What is “Best Execution” on Betfair?

Best execution (also labelled Best Price Execution by Betfair) is a guarantee that when you submit a back or lay order your bet will be matched at the most favourable odds currently available – or not at all. In other words:

- Back bets are matched at the highest available price.

- Lay bets are matched at the lowest available lay price.

If the market moves in your favour between hitting Place Bet and the order being matched, Betfair automatically improves (i.e. price improves) your odds – you never have to re-submit at the better price. If the improved price cannot be matched immediately, the unmatched remainder will sit at your original requested odds.

Why People Get Confused

Many newcomers assume they can simply “leave” a back order at, say, 1.80 and have it sit there until the market trades down to that exact price.

In reality, Betfair’s best-execution logic means the moment you press Place Bet your order is treated as a limit with permission to fill at anything better than 1.80—so if the lay queue already shows £ available at 1.81, 1.82, or higher, your stake will be snapped up instantly at those higher odds.

The bet never waits for the price to tick down, because Betfair believes it is improving your position by giving you immediate execution.

To achieve a true “price-triggered” entry you therefore have to automate the order—either with an in-house strategy in Bet Angel’s Guardian/Servant tools or a custom API script—so that it only fires after the last traded price has crossed your threshold.

How Best Execution Works on the Betfair Website

- Submit an Order

- Specify your stake and odds as usual.

- Behind the scenes Betfair converts this to a limit instruction sent to its matching engine.

- Matching Phase

- Betfair scans the order book (and cross-matching engine) to find better opposing offers.

- Any slice of your stake that can be matched at a superior price is auto-improved; the remainder waits at your stated odds.

- Confirmation

- The bet slip returns the Average Matched Odds figure – often a tick or two better than requested.

- Your P&L projection updates immediately to reflect the improved fill.

Example

You attempt to back at 3.00 with £200. While your bet is routing, the lay side drifts to 3.05. Betfair matches as much of your stake as possible at 3.05 before posting any leftover at 3.00. You gain an extra £10 in expected profit without lifting a finger.

Best Execution Inside Bet Angel

Bet Angel connects via Betfair’s API-NG, so every order you fire from the software still enjoys Betfair’s best execution guarantee. The difference lies in how the order is presented and managed on your screen.

Best Execution and Bet Angel

Whether you’re placing a stake from the one-click grid, dropping it into the ladder, scheduling it in Guardian or triggering a Servant, every Bet Angel order travels to Betfair with the same best-execution flag, so the exchange’s matching engine treats them identically and will always improve your odds if a better price is available.

The difference is that Bet Angel makes it effortless to offer prices—letting your bet sit in the queue to be taken—or to unleash sophisticated rule sets that fire only when pre-defined conditions are met.

From drip-feeding stakes, offsetting and chasing, to complex cross-market triggers, you can automate virtually any entry or exit logic you can imagine, safe in the knowledge that best execution remains the constant safety net underneath.

Backing at 1.10: Why the Website Jumps, and How Bet Angel Can Waits

Suppose you want to back at 1.10 because your model values that as the cut-off for a profitable entry.

- On the Betfair website you can only submit a normal limit order. Best execution means any money already available above 1.10 (e.g., 1.11 – 1.20) is snapped up first. Your order is therefore matched immediately above your target price. There is no native way to instruct Betfair to wait until the price actually trades down to 1.10 before firing the order.

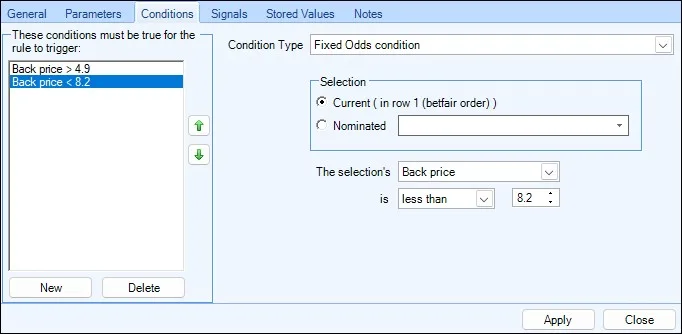

- In Bet Angel you can solve this with Automation Rules (or a quick self-written Servant):

- Create a Place Back Bet rule that is triggered only when the last traded price ≤ 1.10.

- Set the odds for the instruction to LTP (Last Traded Price) or a fixed 1.10 and choose EXECUTE ONCE.

- The rule sits dormant in the background; when the market finally touches 1.10 your bet fires instantly – and best execution still upgrades the fill if further improvement is available.

This approach lets you emulate a stop-entry order, something Betfair’s website does not offer. It’s especially powerful in volatile in-play markets where odds frequently ping through key price levels.

Bet Angel Automation

If you visit the Bet Angel forum there are several examples that can help you achieve what you want.

Look in the FAQ thread titled “Back at Odds lower OR Lay at Odds Higher than the Current Price” – it contains a downloadable .baf file that places a back bet only when the last-traded price drops to your target odds.

https://forum.betangel.com/viewtopic.php?t=11621

If you prefer a point-and-click version, the same post links to a ready-made Servant (“Back @ Price Servant”) you can launch from either the ladder or one-click screen.

https://forum.betangel.com/viewtopic.php?f=58&t=16235

You’ll also find other price-trigger examples in the Automation – Shared Files area.

https://forum.betangel.com/viewforum.php?f=52

Key Takeaways

- Best execution is your friend: it silently upgrades your odds every day, on every market.

- The mechanism lives on Betfair’s servers, so whether you use the website, Bet Angel’s one-click panel, or the ladder, the guarantee is identical.

- Learn to read market depth on the ladder and you can predict when price improvement is most likely – and size up accordingly.

- Combine Bet Angel’s automation (offsets, fills, Servants) with Betfair’s best execution for a powerful, zero-costedge over the field.

Harness it, and those extra ticks will stack up in your favour – turning marginal trades into consistent long-term profit.