Betfair Premium Charge - Explained

The introduction of the Betfair Premium Charge was a landmark moment in the evolution of betting exchanges. Once known as a platform that rewarded the skilled, the persistent, and the statistically minded, Betfair suddenly introduced a fee structure that many punters deemed punitive.

This move altered the long-term profitability landscape and forced traders to reconsider their strategies. In this blog post, we will break down the Premium Charge’s key components, its historical timeline, the rationale behind its creation, and why its evolving structure ended up affecting more traders over time.

The Early Days of Betfair (2000–2007)

In its infancy, Betfair revolutionised the betting industry. The exchange model allowed individuals to set their own odds, back and lay selections, and trade positions in a manner more akin to financial markets than traditional bookmakers. The initial commission structure, which revolved around a percentage of net winnings each market week, rewarded consistency and took a relatively small slice of the pie.

During this period, nobody had even heard of a “Premium Charge.” Successful punters could enjoy compounding gains without worrying about back-end fees. This gave a great deal of hope and motivation to ambitious traders who saw a path to long-term profit.

The Introduction of the Premium Charge (2008)

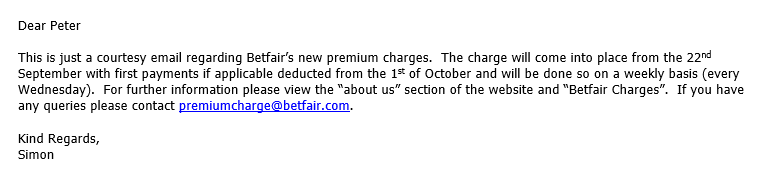

By mid-2008, Betfair announced the introduction of its Premium Charge. The initial rate stood at 20%, but importantly, it was only applicable to the exchange’s most successful users. The stated purpose was to extract more revenue from the consistently profitable segment of traders who placed a large volume of bets, often at high frequency, and who generated substantial returns while paying relatively low levels of commission compared to their winnings.

Betfair argued that these successful traders were disproportionately benefiting from the liquidity provided by casual bettors, yet not contributing enough in commission relative to their profits. By introducing this additional charge, Betfair aimed to ensure that the most profitable customers paid a fairer share of the overall revenue pool.

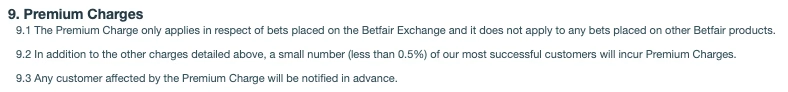

At inception, the company stressed that the majority of customers would never pay the Premium Charge. The threshold was high enough, and the conditions strict enough, that only a small fraction of ultra-successful punters were affected. For most users, the introduction caused no immediate financial hit—at least not yet.

The Escalation: Super Premium Charges (2011 onwards)

As years passed, Betfair refined and, some would argue, tightened the net around successful traders.

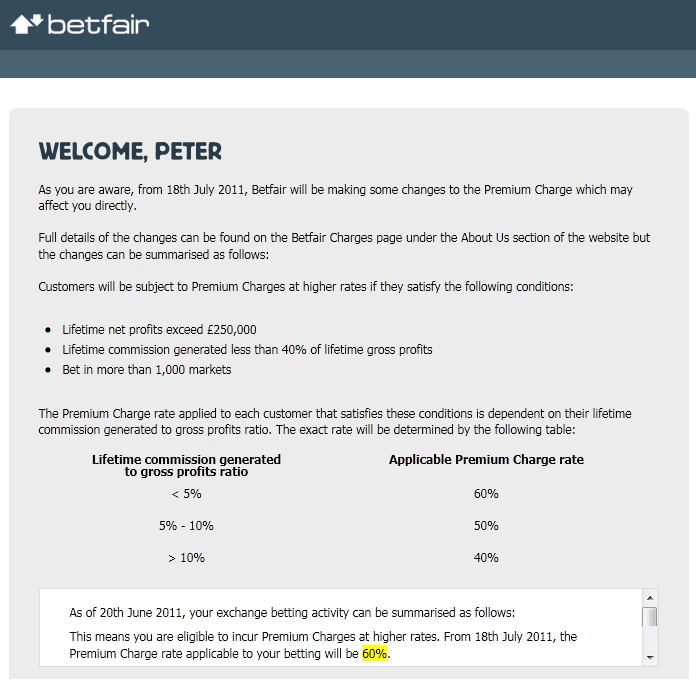

In 2011, the exchange introduced “Super Premium Charges,” with rates that could reach up to 40% or even 60% for the highest-earning customers. This shocked the betting community. Punters who had worked tirelessly to hone their craft now faced what felt like a perpetual tax on their success.

The confusion nature of the charges meant that more people thought they would be affected, but in fact, few were. You had to jump over several hurdles such as markets traded, comission generated and a lifetime limt to qualify for the charge. But everybody felt affected.

Because the higher rates only affected a small number of very succesfull people. Some people pretended to be payers, simply for effect. Strange, but true.

Over time, the thresholds and rules that dictated who would be caught by these charges became less forgiving thanks to fiscal drag. The net widened. While many participants still dodged the extra fee, the pool of affected traders began to grow as long-term consistent profitability became increasingly likely to trigger these hefty charges.

Why It Was Created

Betfair’s narrative behind the Premium Charge was that a minority of users were benefiting from the majority, while paying little in terms of commission. They believed that without additional fees, these highly profitable customers would perpetually extract value from the betting ecosystem, reducing the liquidity and attractiveness of the exchange over time.

By introducing the Premium Charge, Betfair sought to:

- Increase their revenue from the “top-tier” winners.

- Reinforce a more balanced commission system where success correlated with a fair contribution to Betfair’s costs.

- Discourage what Betfair perceived as exploitative trading strategies that relied on razor-thin edges and high turnover but contributed limited commission.

The Gradual Envelopment of More Users

At the outset, Betfair claimed that only a tiny percentage of traders would be impacted. However, as the years rolled on and profits accrued, many traders found themselves nudged into Premium Charge territory. What began as a measure affecting only the “super-elite” became relevant to more mid-level traders as well.

Why did this happen? Because the Premium Charge’s criteria often revolved around long-term profitability thresholds. For committed, successful punters who slowly but steadily built their bankrolls, it was only a matter of time before their aggregate winnings crossed the lines that triggered the charge. The longer they remained profitable, the closer they got to paying these additional fees. In effect, longevity and consistency in winning—once the hallmarks of a trading dream—could now lead to a costly penalty.

The Lifetime Limit: A Bit of A Dream Killer

Perhaps the most demoralising aspect of the Premium Charge structure was the introduction of a lifetime earnings limit. Once traders surpassed certain long-term profit thresholds, they would be locked into paying Premium Charges indefinitely. For Betfair traders above that limit when it was introduced the charge was, effectively, retrospective.

For many, this shift was a dream killer. One of the core appeals of Betfair was the promise of scaling up over time—learning from small stakes, discovering strategies, and gradually compounding profits into something substantial. But with a lifetime limit, the horizon was no longer limitless.

Once a trader approached these earnings thresholds, they knew any additional profit would be effectively taxed at a high rate, sapping the motivation to continue improving or scaling their strategies.

Assessing the Long-Term Impact

The Premium Charge and its subsequent iterations played a huge role in changing the culture on Betfair. It discouraged some and forced others to find creative ways around the system. It also changed the balance between Betfair and its customers: no longer just a neutral marketplace where winners were celebrated, the exchange now had a direct financial interest in successful customers.

While Betfair remains a leading betting exchange, the Premium Charge’s legacy is one of controversy and resentment amongst the serious betting community.

What began as a measure targeting a handful of elite winners ended up reshaping the betting ecosystem as we once knew it.