Betfair Trading at Large Race Meetings

I’ve made it no secret that I love the big meetings because of the higher market volumes that are in the market. But, contrary to opinion, you don’t need a big bank to get a big result if you are trading effectively and with a bit of flexibility.

Let’s explore, in horse racing markets, how different trading a small race is from trading a ‘big race’ in betting markets terms.

Market risk

People are often curious when I post large amounts from a big race. So, what am I doing differently, aside from using the best trading software, Betfair (shameless plug)?

Every market carries a certain level of risk. For example, in a race where none of the horses has run before, the market can only guess the correct price, leading to significant price swings. These swings can result in either one of your best trades or one of your biggest losses.

I always consider the risk of a large loss and frame my trades around that. When I identify a market with potential movement and find strong reasons to believe it will move in a specific direction, I enter with a stake proportional to the risk. If I don’t see a clear opportunity, I simply wait for the next one.

When I do take a position, I tend to be cautious, only adding to it once the move is clearly underway and I have a better understanding of what’s happening.

Strong versus weak markets

Let’s compare an unknown horse in a low-profile race to a well-known horse in a top-tier race.

In the high-profile race, everyone knows the horse’s name, understands its form, and has a good idea of how it will perform. It’s competing against other strong horses, so the market is more confident about the true odds.

With all horses having strong form lines and being closely analyzed by pundits and the crowd, large price movements are less likely. While big moves can still happen, they’re far less common in these more predictable, high-quality races.

How my approach changes in a ‘big’ market

How does this influence your approach to the market?

For me, it’s straightforward. If I expect significant market movement, my focus is on predicting that move accurately. I need to understand and anticipate where the market is heading, with confidence in my ability to read it.

In such cases, I use smaller stakes, which can lead to bigger returns. My risk strategy adjusts based on the level of risk I’m taking. In large markets, I’m more comfortable using larger stakes due to the higher certainty in market movement, better liquidity, and earlier arrival of money.

Importantly, in large markets, you can quickly exit a large position if things go wrong. It’s crucial to cut losses swiftly rather than hold on and hope for a turnaround.

When trading large markets, I place many orders but might scratch 30% of them. Speculating is easier in large markets because you can exit quickly with minimal losses. In smaller markets, the movement is faster and less predictable.

Volume is not liquidity

It’s crucial to distinguish between volume and liquidity in trading. Liquidity lets you enter and exit the market easily, while volume alone doesn’t mean much. Many exchanges have volume but lack liquidity, which is key for successful trading.

Volume refers to the total amount traded in a race, while liquidity is about how quickly that amount is being matched. In low-liquidity markets, you might struggle to exit a position if things go wrong. In contrast, in larger races with high liquidity, you can trade with more confidence and exit positions easily if needed.

I grade every market by liquidity and volume. My stake adjusts based on the expected trading volume and liquidity. You can have low volume but high liquidity, and vice versa, so it’s important to assess both.

In large races, the main advantage is the ability to enter and exit positions quickly, even if it’s for a small loss. This flexibility is often missing in smaller races.

Why you don’t need a big bank to trade a big market

Many people mistakenly believe that large stakes are required to make big profits in sports exchange markets, but that’s simply not true.

If you check the market depth on the ladder interface, you’ll see a lot of money waiting to be matched. This means prices move slower, but because markets are tradable over the long term, you can place multiple orders and get instant settlement on your positions.

Coming from financial markets, I was amazed by betting exchanges’ instant settlement feature. Unlike the old stock market system where you waited for trades to settle, here you can trade just like in financial markets but with immediate results. This allows you to re-enter the market quickly, especially in highly liquid markets, and make multiple trades efficiently.

For example, trading £5,000 twenty times would give you £100,000 in total trade value. Even smaller trades, when done repeatedly, can quickly add up to substantial sums.

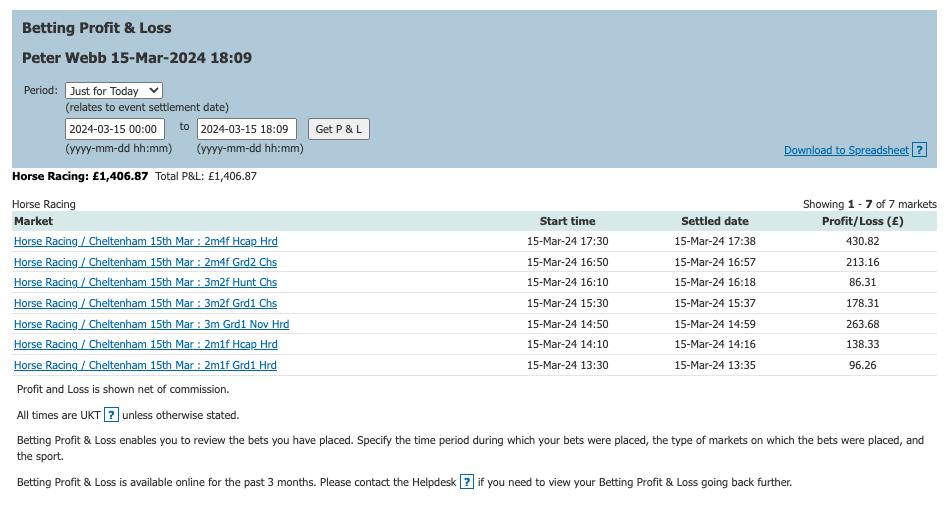

However, there’s skill involved. You need to understand the market, manage your positions, and use tools like Bet Angel to trade efficiently. In the following video, I explain this in detail, using a high-turnover day as an example.

Trading at a high level

Trading this way demands intense concentration, which is challenging for beginners. It’s hard to narrate in real-time because you’re constantly entering and exiting positions, with the goal being to minimise losses and hopefully secure a profit.

The key is to place plenty of orders and manage risk effectively. As you become more comfortable with risk management and the tools available, this approach becomes second nature. When you find the right market, it’s easy to dive in and start trading actively. I’ve done this live, and it’s nearly impossible to describe what’s happening because it all unfolds so quickly. It can be quite intense!

Risky business

You need to be selective because this strategy doesn’t always work well. Often, the money isn’t there, and the risk is higher.

Betfair markets have become increasingly volatile over time, making larger stakes more dangerous. A sudden move can catch you out with significant money, which can be painful. You must adapt your trading style based on what you see. When I refer to larger stakes, I mean orders in the low thousands, but I rarely go higher. I prefer small, frequent trades, as using too much money can hinder profitability. The key is to trade little and often.

Sometimes, the appropriate stake and frequency are clear; other times, you need to gauge how the market is filling your orders.

Practice makes perfect

After trading numerous markets over the years, it becomes easier to recognise when you’re on the right track.

However, large markets are rare, and beginners often find them unfamiliar and challenging. The limited opportunities to trade these markets each year make it even tougher to master them. It was the same for me when I started—I had to figure it out gradually. There’s no shortcut, just lots of practice.

Unfortunately, you don’t get many chances to practice, so it takes time to perfect your skills.

Summary

I love trading big races, even though many avoid them. For me, they’re a chance to secure substantial totals, so I always aim for a big result when the opportunity arises, and this year I’ve done that successfully in most major races.

As a trader, you might choose to have some fun and experiment with these races. The key difference is that they generate larger volumes over longer periods, allowing them to hold stakes more effectively. It’s all about balancing volume and liquidity.

It can be frustrating when trades aren’t matched quickly, but starting with small stakes and profits is perfectly fine. That’s how I built my confidence years ago, gradually increasing stakes as I became more comfortable.