I’ll never forget the joy of discovering greening-up, as I called it, hedging as you may call it in the stock market, or cash-out as the betting industry chose to adopt.

The ability to win whatever the result was a real game-changer.

Nowadays, it’s accepted as a standard feature on betting exchanges and sportsbooks, but this wasn’t always the case. Betfair didn’t introduce the concept of cash-out, which was then widely copied by the industry, until 2012. This was a full ten years after it was first commonly being used on betting exchanges.

Cash out is just another bet

It’s easy to misunderstand how cash-out actually works. It’s not some magical button or Betfair procedure, it’s really just another bet. So it’s important to understand that, so you can account for that when trading.

Most cash-out features with sportsbooks are simplistic and geared towards their providers. But when trading you have a lot more flexibility in terms of how you use it, but that carries additional risk if you use it incorrectly.

How does cash out work

To explain how cash out works, let’s look at a simple trade: –

A simple trade

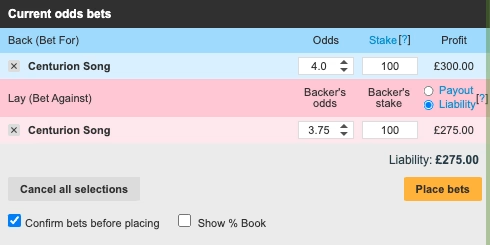

- We open a trade by backing £100 at odds of 4.00

- To close the trade we lay the same selection with £100 at odds of 3.75

- Our profit from this trade there is 4.00-3.75*£100 or £25

That £25 profit is ONLY if that selection goes on win the actual event. We have created a free bet with no loss if any of the other selections go on to win. We have made £25 because that is the difference in profit between backing £100 at odds of 4.00 and the liability of laying at odds of 3.75.

To hedge that position you would press any of the various ‘greening’ buttons or options in Bet Angel. But what that does is actually place another bet in the market.

So to hedge that position so that you win whatever the result, Bet Angel places another lay bet into the market at odds of 3.75 for £6.67. Our profit has reduced from £25 to £6.67 but that means we win regardless of how goes on to win.

The importance of trading correctly

The process of trading is simple, you lay at a lower price than you back at and cash out / hedge your position. Simple. As always the reality is different.

I often see people, including ‘professional’ traders who seem to follow the wrong trading process. If you trade correctly, you will use the same stake on each trade, open a trade, close a trade, possibly repeat that trade, and then hedge when you are finished.

You do this because you can control your risk and manage your trade effectively. It brings your focus to the trade at hand and controls your money management of that trade. The hedging position should be the last thing you do on a trade, not part of the trade.

Let us examine why that is the case.

What happens if you don’t trade correctly

If you try and make the closing trade and hedging position at the same time, you can do that. But it’s very unlikely that you will win every trade you do on any specific selection. When you trade in and out then finally hedge, you hedge your net profit. If you trade and hedge out, you skew your individual trade in a market to that closing trade and tend to blow up your trade and money management.

You also have this problem that the final hedging position will be large and that could influence the trade or cause additional problems that I will touch on in a minute.

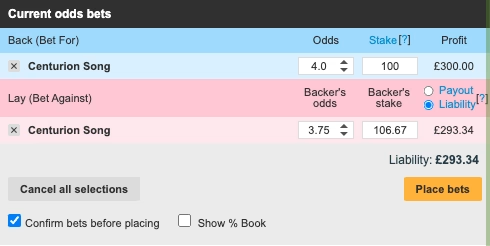

The second image illustrates this point more clearly. The total amount of bets on the lay side are £106.67. If you trade in and out then the final bet that spreads your profit across all selections is just £6.67. If you wait till the last moment to hedge your position and do so without trading out first your final bet will be £106.67

I know which final position I would prefer. So I trade in and out and the very last thing I do is to hedge that profit or loss at that point.

When cash out can cost you a profit

When you trading you should find yourself clean out of a position and the final action you should take is to hedge that profit. Then give yourself a pat on the back for a nice trade!

If you wait till the last moment to hedge and your closing trade includes that hedge you could find yourself in trouble. That last trade will be comparable to your open position and it may mean that you end up chasing that final closing position, including the hedge, and it may not fill. Things can be worse though.

Let’s say that your WiFi freaks out, the Betfair API freaks out or something else happens that interrupts your communication to Betfair. Suddenly you have a large liability outstanding and rather than just having a free bet, you may actually just be having an outright bet on the next event.

So it always makes sense to trade ‘correctly’. As in, focus on the trade and then hedging is the final you do. Don’t be tempted to just slap the greening button. While it can hedge, it’s actually a closing and hedging position combined if you haven’t completed a trade.

Why hedging in-play carries much more risk

In the section above, I touched on what could happen if your connection to Betfair is interrupted. There is one time when your ability to cash out correctly will be interrupted by default.

When the market is in-play Betfair apply a bet delay by default. The market will feel very different from its pre-event state. Pre-event there is no bet delay, so you can open, close and hedge positions quickly and with ease.

It’s important at this stage to re-appraise what we have covered above. If you open and close a trade, you simply hedge the profit you have made. If you open a trade then fail to close it and just attempt to hedge that position, your hedged bet includes your closing trade as well!

The most common mistake we see is that somebody has a profit and then, without placing a closing trade, the greening button is pressed. This dumps a large position in the market and because of the bet delay, it will take a while to reach the market. By the time it has reached the market the price has moved and the position is unfilled and remains in the market.

What was a nice £25 profit or £6.67 whatever the result is probably now slipping into a losing position? In a panic, the greening button gets pushed again but at that exact moment the market shifts and fills your old position and the new lay bet for £106.67 enters the market and also gets filled. You have managed to turn a profit whatever the resulting trade into a thumping loss. Things generally get worse from there!

You can use features like ‘with greening’ to ensure any in-play trade is limited to just two positions. But if you do attempt to hedge inplay our advice to you is to ensure your trade is closed before hedging to substantially reduce your risk.

If you can’t do that or make a mistake, then when that initial hedged position goes into the market, give it time to get matched and then calmly cancel and re-apply it if needed. But always keep an eye on your overall position via the profit and loss column/number to ensure you understand what is happening.

What you need to know and what you should be doing

We have seen people repeatedly click the greening / heading features in an attempt to get out of a position. This is not the way to use this feature.

If you have not closed your trade properly you will be essentially placing a lot of new bets into the market. You will not actually be attempting to hedge that position. You could find yourself in a world of hurt.

If you experience a timeout to the Betfair API, the Betfair API has a problem reporting data or you are clicking that button during an inplay bet delay, Bet Angel can only act on your instruction and you could be adding to your liability in the market. Therefore always check what is happening and be aware of that.

But the moral of this story is, that you should never find yourself in that position in the first place!

Follow a predetermined trading plan, execute it well and do everything to minimise your risk and exposure in the market. That’s the best way to trade!