Bet Angel - Correlation tool

In the fast-paced world of trading, finding an edge can make all the difference between success and failure.

One powerful tool that can help traders identify potential edges is the Bet Angel Correlation Tool.

This innovative feature is designed to help you understand how different markets or selections are related to one another, providing insights that can enhance your trading strategies.

In this blog post, we’ll delve into what the Bet Angel Correlation Tool is, how it works, and how you can use it to boost your trading performance.

Finding the correlation tool

If you are on any main screen on Bet Angel and have not undocked any items. You will find the Correlation Tool alongside other features such as the market overview screen, inplay trader, and Tennis trader.

Just click on it to start it up.

What is the Bet Angel Correlation Tool?

The Bet Angel Correlation Tool is a feature within the Bet Angel software suite. You need to be using version 1.62 or higher.

This tool allows traders to analyse the relationship between different markets or selections to determine how closely they are correlated. In simpler terms, it helps you understand how the price movements of one market or selection might influence or be influenced by another.

In any market, the total book percentage must always converge to 100%. This means that the movements of individual selections are interconnected. For instance, when a favourite in the market is heavily backed, other selections will inevitably drift. The Correlation tool doesn’t just highlight these relationships; it quantifies them.

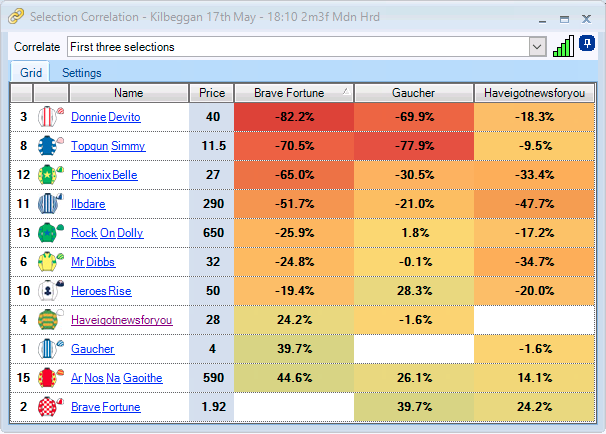

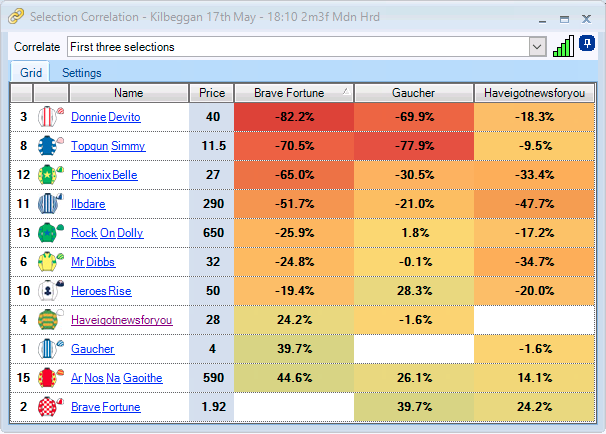

Presented in an easy-to-read table format, the Correlation tool offers extensive customisation options to align with your unique trading style. This ensures you can quickly and effortlessly grasp the correlations within the market, enabling you to easily understand and trade what you are seeing within any market.

How Does the Correlation Tool Work?

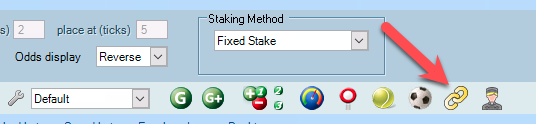

To open the Correlation tool click the linkage icon on the toolbar. You must be using version 1.62 or higher.

The Correlation Tool works by calculating the statistical correlation between two sets of selections. It measures the strength and direction of the relationship between these sets, providing a correlation coefficient that ranges from -100% to +100%.

+100% indicates a perfect positive correlation: This means that as one market or selection’s price increases, the other market or selection’s price also increases proportionally.

-100% indicates a perfect negative correlation: This means that as one market or selection’s price increases, the other market or selection’s price decreases proportionally.

0% indicates no correlation: This means there is no predictable relationship between the price movements of the two markets or selections.

The signal strength indicator automatically tells you if Bet Angel has enough data to accurately quantify a correlation.

Using this tool, traders can visualise these correlations through graphs and numerical data, making it easier to spot potential trading opportunities. For the first time ever, you can see and quantify where interest is, and isn’t in a market. This will tell you if the market is pushing for, or against your current position.

Correlation tool settings

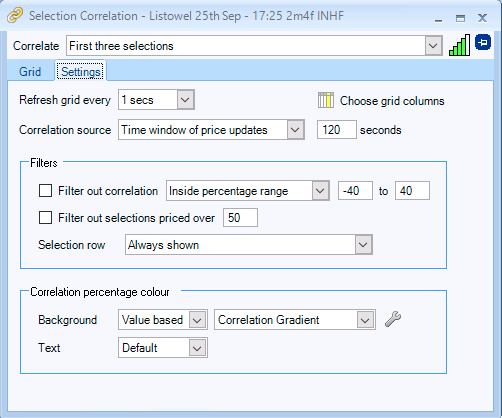

There are a number of settings you can change to suit how you prefer the tool to gather and display information.

A ‘signal’ strength indicator appears in the top right fo the tool to indicate it has enough data to display an accurate correlation. You can also choose the time window it gathers data and how often it displays the correlation in the main display grid.

The filters allow you to strip out an ‘noise’ that the correlation tool could be producing, or that you don’t wish to view.

The final section allows you to change the colour gradients used when display information via the tool.

Summary

The Bet Angel Correlation Tool is a powerful addition to any trader’s toolkit. By providing valuable insights into how different markets or selections are related, it enables you to make more informed trading decisions, manage risk effectively, and identify profitable opportunities.

Whether you’re a seasoned trader or just starting, incorporating this tool into your trading strategy can help you gain a competitive edge in the market. Start exploring the Bet Angel Correlation Tool today and see how it can enhance your trading performance.

Happy trading!