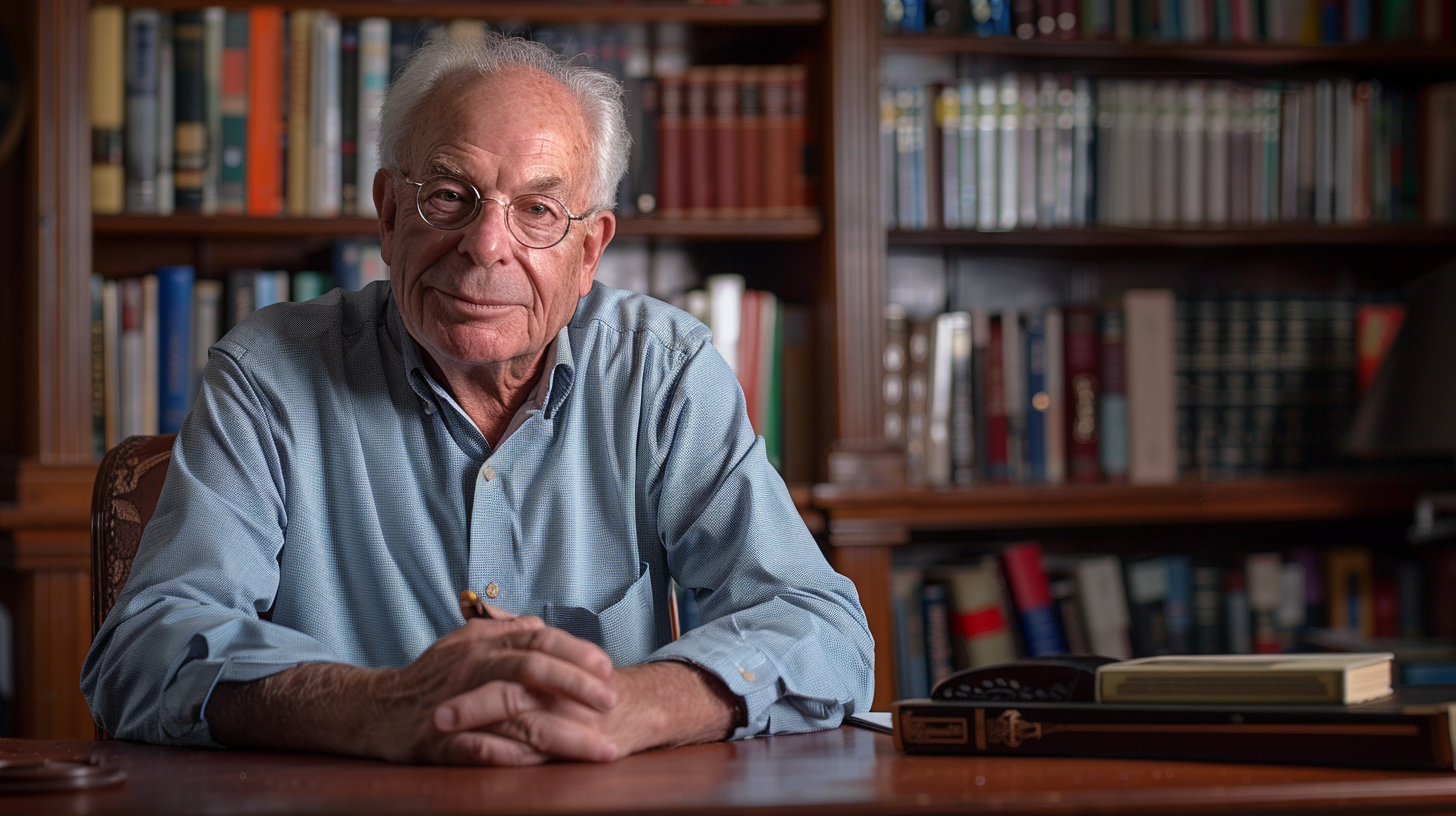

Why I owe so much to this man

On my long journey through the markets, I spotted something odd.

Despite considerable academic evidence that the markets were efficient, they didn’t seem to be to me.

I made money consistently and knew what to do, but one question bugged me. Why did it continue to work? Surely, if the market was efficient, there was no way I could keep picking off these opportunities.

I could see them and quantify them, but I still couldn’t understand why they occurred.

A hint at what I was looking for

Being a Berkshire Hathaway shareholder, I had a hint. During the annual general meetings, Buffett and Munger would often hint at the fallacy of the human condition. A notable quote by Charlie Munger, was: –

“The human condition: Ineptitude mixed with Overconfidence.”

I knew I was on the right track and that part of my edge was due to psychology, but I couldn’t quantify it.

A massive light bulb moment

Wind forwards some years, and I listened to an audiobook while driving around California. Again, it told me things I already knew but stopped short of giving me the exact thing I needed, but it resonated with me.

During that trip I really dug deep and found that out about the nobel prize for economics in 2002, which was awarded to a psychologist, that was interesting.

What caught my attention was that a psychologist was awarded the prize for economics. Having studied Von Neuman’s Game theory and its application in the real world, I felt that this paper was right up my street.

I found the paper, which was published in 1979 and read it.

It was a massive lightbulb moment for me, the penny dropped and suddenly everything made sense.

Suddenly it all made sense!

Right in front of me, I had academic research that showed exactly what I could see. Not only that it tied the maths of it to the psychology of it.

Immediately I returned to my data to see if I could find some matches with the research and I did, it was everywhere. Staring me right in the face was a replication of what the paper said.

I wrote to Kahneman to excitedly explain how I could replicate his findings in a different market. Of course, because it’s betting, nobody was interested in following up. But I had my confirmation.

So my next step was to do the opposite, to try and understand not what I could see, but what I couldn’t see. If I could understand these biases well enough, I could reverse engineer them to tell me where to look for them in the market.

While the first part of my career was looking to exploit inefficiencies I could see in data, the second half was inefficiecnies in the human mind and how that translated into the markets.

It was much more valuable than I could have ever imagined. I could now predict where the errors where likely to occur. So I would sit in those areas and wait for them to occur.

Beyond markets themselves

The exciting thing about relating the paper to my work was that I started to spot things beyond where I was initially looking.

One thing that bugged me early in my career was people’s lack of belief in what I was doing. Suddenly, that all made sense, and I realised that was an essential part of what made a market. Not only that, but I could think about what those people were thinking about.

I also learned that I could gain insight into how a sport was being played using the principles I learned through Kahneman’s work. It was getting that insight into how teams or individuals would play given certain circumstances. What did they feel at that point, and how would they react?

This allowed me to get one step ahead of what could happen rather than wait for it to happen.

How it transformed what I was doing

Up to that point in my betting and trading career, I was doing pretty well.

I’d carefully research something and then deploy it in the market to scale it. But over time, it was sort of inevitable that my edge would get a bit thinner.

However, learning about Kahneman’s work catapulted me to a completely different level. Not only did my understanding of what I was doing and why it was working improve. It allowed me to search for opportunities from a completely new angle.

I suddenly knew exactly where I should look for opportunities, and I found them everywhere!

And for that reason, I own Kahneman so much!