My first year of Betfair trading for a living

So, let me take you back over two decades ago…

I was still in a ‘normal’ job working in a 9 to 5, but I had this dream of sports trading on Betfair for a living! I’d traded financial markets and prior to that, I’d done a lot of stuff in gambling markets. Here was my chance to combine the two.

In this blog post, I am going to review how I came across the Betfair exchange, opened a Betfair account and created Bet Angel. How it helped me trade and what happened in my very first year as a professional Betfair trader.

Of course, everybody has different experiences and I was trading before people even knew trading existed, so it will probably be a very different experience from yours… take that into account.

When I found Betfair, betting exchanges weren’t very well known. Back then, you had no Betfair trading software to use, and strategies weren’t very well known. If you start trading now, you’re going to be several steps ahead then I was because betting exchanges have evolved and grown to give traders more opportunities and information. Now we have a prolific range of strategies and tactics out there, although some of them I would deeply question! The market is also very competitive now.

However, the experience you’ll go through will probably be somewhat similar to the one that I went through. I made the leap from a secure job into trading full-time at a time when nobody did that, and everybody thought I was completely crazy!

Taking a risk isn’t always successful…

To understand my decision to become a full-time trader later, you must learn more about my background. Through these experiences and challenges, I learnt a lot about taking risks and handling the outcomes when they don’t always go to plan…

I was in a secure tech job when I saw the opportunity to become involved with an Internet service provider in the mid-90s. I’d been messing around on Prestel, CompuServe, and the Internet for many years.

I could see what was about to happen with the Internet, so I wanted to jump into this emerging business.

Missed opportunities

Throughout my life, I’d often been good at catching waves of technology and tried to get involved with them in the early stages. But always as an employee, so of course, I had to take this opportunity!

But having a good idea is one thing; doing something about it is another. Making it a success is something completely different altogether.

My job with the Internet service provider, was revolutionary. I could see what the internet was, it knew all about it, it understood the technology behind it.

However, my decision to back their idea was a matter of the right place and the wrong time. It was riding on the success of the internet too early on, and unfortunately, this time, it didn’t work out for me. They ran out of money before the Dot Com boom had even happened.

I can come incredibly close to a big payoff, but just failed.

Like many mistakes in life, mistakes and failures can catapult you forward and lead you to other opportunities in ways that you may not understand then.

My involvement with the Internet service provider allowed me to push myself toward dealing with companies involved with the Internet.

Sometimes, you never know where that will lead you.

The Birth of the Betting Exchange and Betfair

One of those emergent technologies that I spotted early on in development was peer-to-peer networks. Out of these peer-to-peer networks emerged the betting exchange.

In a way, I knew about betting exchanges before they had even been created! I signed up with them immediately as soon as these betting exchanges came online.

I started my experience with arbing, what most people recognise as matched betting, then Betfair trading. I was one of the early adopters of Betfair when it opened for business on 07/06/2000.

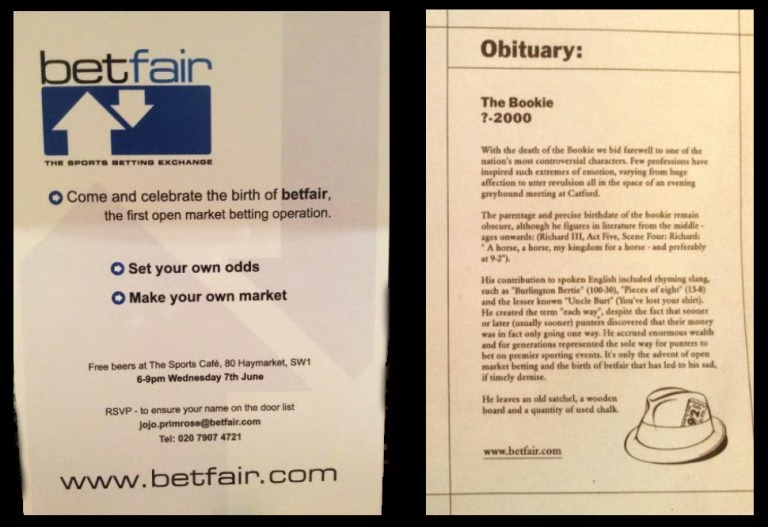

Their press release gives an insight into Betfair’s company aims, discussing the death of the bookie and how peer-to-peer technology would replace the bookmaker.

The betting exchange business had opened up, and there were many players in the game! It wasn’t just Betfair that I set up my account with, I joined all these services. I had no idea who the winner was going to be at that particular point in time.

Betfair’s domination

At this time when all these betting exchanges were emerging, I actually preferred this platform called ‘Flutter’. The concept of ‘flutter’ was you actually communicate with the person that you’re placing bets within the market.

For example, you’d place a bet upon England, and you would comment on that bet:

“England is going to crush Spain today!”

– You

And then somebody would place the counterbet

and also put a little note replying to your first lay bet…

“No, they won’t. Have you not seen that Spain are playing really strong this season?!”

Then those two bets would get matched, and you would exchange a little note for it as well! I quite liked that, it added a little bit of something to the bets that you were placing. It was matched betting with a difference!

However, you had ‘flutter’ and had Betfair. Both of them were pretty big at that particular moment in time…

To counter their rival, Betfair, a true betting exchange, decided to take over ‘flutter’. This was mainly thanks to the large funding that Betfair had.

Technically, it was a merger, but like with many mergers, you tend to have a more prominent partner, and in this case, it was the Betfair betting exchange.

That was probably one of the industry’s most strategically important things early on. You find this a lot with startups; if you have more funding than your opponent, you can take them out or out-compete them.

That’s what happened very early on within the betting exchange industry. There were hundreds of these models, and they all started to consolidate back into a smaller number. These betting exchanges underwent many mergers and closures from the many to the few.

Learning how to succeed at ‘arbing’ through my early days

I started with ‘arbing’.

When you look at arbing, you tend to match off positions on the exchange with bookmakers. I did this across multiple exchanges anywhere I could, and this was the most obvious place to start when looking at these exchanges.

What I did around this period was similar to what you see with matched betting.

One of the issues you have with ‘arbing’ is that you can often find risk involved. For example, counterparties may not be willing to take your bets, terms or odds can be amended after the situation, or you wouldn’t get a payout.

This was one of my biggest problems; some bookmakers were not paying out. They were outright refusing to pay me or delaying my payments! Some things never change, do they?

But it was really still a pipe dream; back in 2000, I was doing all of this alongside my regular job, but was I seriously thinking about going full-time?

At this point, not particularly! I had a stable job and a young family, so it wasn’t something that you think seriously about doing. It may cross your mind, but it seems too optimistic and naive!

The lack of scale meant it was even more unreachable as there was no liquidity on the exchanges in the early days, so it was not an opportunity. The only chance would have been to work for one of these companies and hope they turned into a much bigger one. However, as I have said before, even that carries quite a bit of risk…

The Big Breakthrough!

Revolutionary news for betting exchanges came when, in 2001, during the budget, Gordon Brown abolished betting duty. Using the internet meant many bets were being taken away from the on-course activity and through established outlets. Many of these were going offshore to avoid betting duties. As a consequence, there was a mismatch in the market, and the chancellor then decided to address that mismatch and abolish the betting duty.

This change to legislation was a big shout-out because there was a lot of potential from this particular period. You could see the potential to go there by looking at the growth the exchanges saw.

Now, there’s an important lesson for you here: It doesn’t matter what you do at any point in your life; there are always going to be risks attached. It’s natural for you and your mind to fear change and to fear big changes. So, leaving a job to do this full-time is a massive commitment as well as a risk.

One of the things that I’ve learnt over time is that very often, NOT doing something carries more risk and has longer-term consequences that are more negative. So it’s essential to put that into perspective.

People often focus too much on the negative and forget the positive. Around this time, I was maturing in my career. I started very low and gradually worked up to much higher levels.

20 years ago, back in the early 2000s, I was getting paid particularly well for the job that I was doing. Even though the job itself was quite a formidable job and involved a lot of things, I sort of reached the point in my career that I felt I pushed as far as I could.

By this point, I had already been wondering about the potential of doing my own thing. It felt like, in a regular career, you would create an opportunity and be applauded, but it was always for somebody else, and their name would take the credit. I began to lose the fear of going out and trying something alone. I just needed an opportunity to go for it full-time.

Viewing full-time trading as an opportunity, not a risk

With everything going on at my stage of life, it happened that using Betfair gave me the confidence to commit to being a full-time trader. Naturally, everybody thought that was the silliest thing they had ever heard!

Nobody had ever done this before, and this decision would be a big jump at this particular point in my career. I had a young family and I was getting paid particularly well, why should I abandon it all for something that seemed ludicrous at the time to absolutely everybody? Very few people could understand what I was going on about!

So, I decided to do it, I made that big leap!

I thought it probably wouldn’t be a problem getting back into a role if it didn’t work out then because I held a senior position in my previous job. I also felt like I needed to make a few life choices.

When you do a big job, it swallows up everything from dawn until dusk. It’s impossible to do a big job with a decent salary without putting all that commitment behind it, but that’s no different from working for yourself or running your own business. However, it does have its perks!

This was my chance to do something with all of these opportunities. Why shouldn’t I give it a go myself? Why waste the potential opportunity? So I did it!

How I traded and how I came to decide what type of sports trader I was

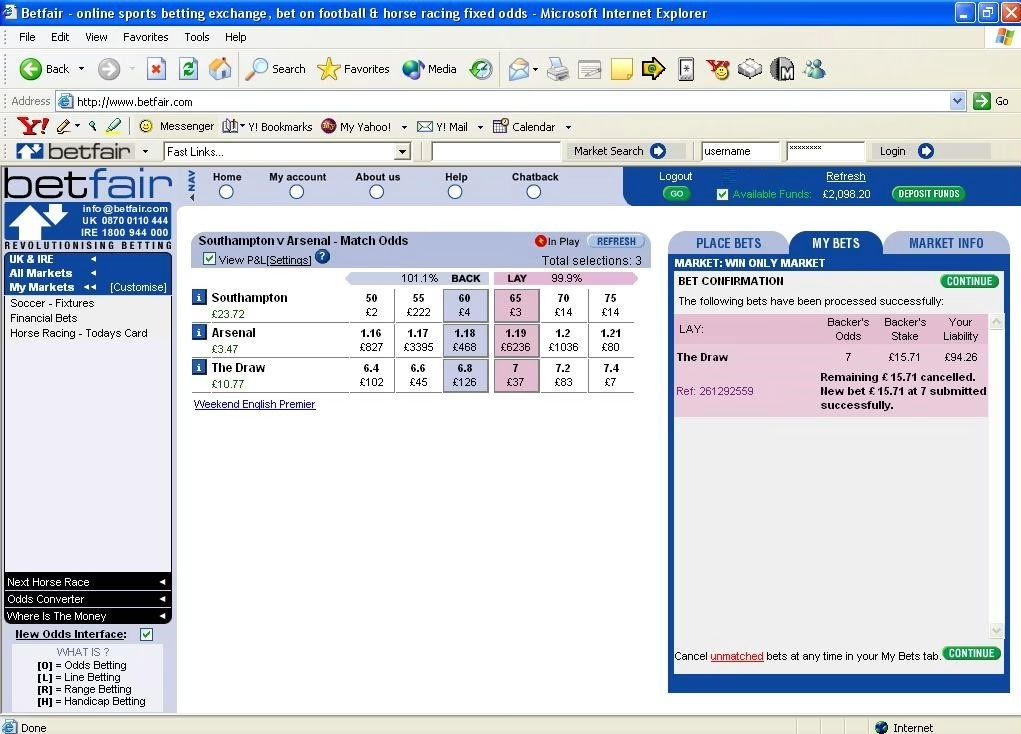

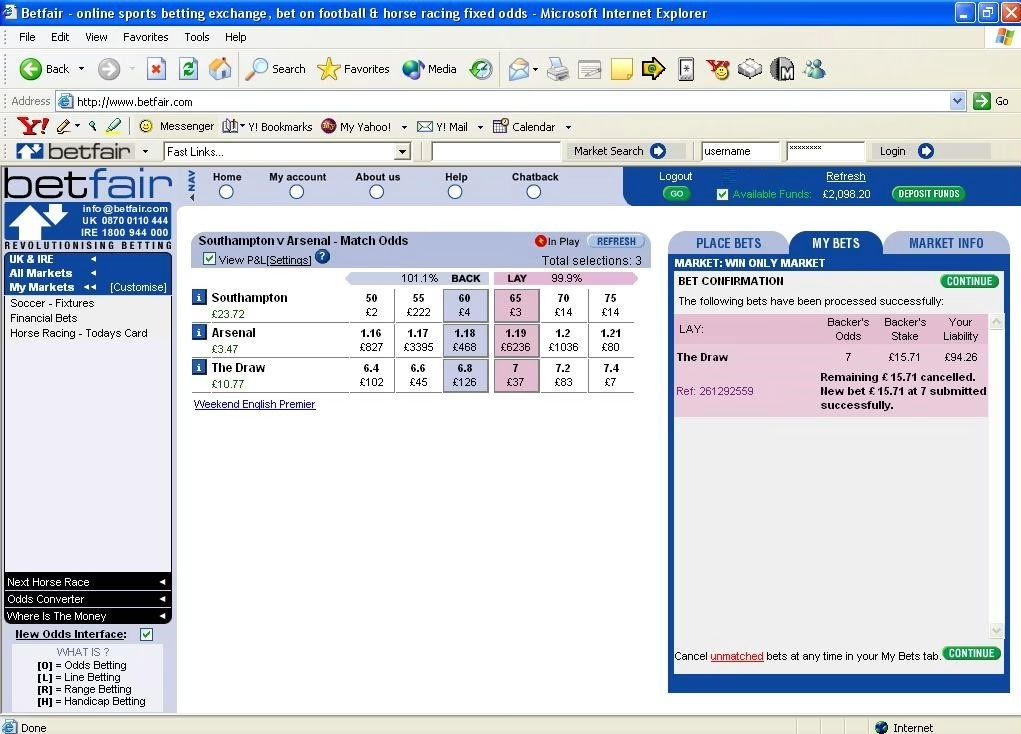

The markets were still relatively immature, and so was my trading. I had a small bank, so the potential risk was higher. I knew the football markets pretty well, and my previous experience within football markets was possibly my chance to have an edge over others.

I started my focus on Betfair football trading. My P&L’s were okay, but nothing spectacular came out of it.

I didn’t have a huge bank and started from £0. I believe I initially funded my account with about £1,000. I started working in these markets, doing small trades and teasing characteristics out of the market.

You’ve got to remember that those markets back then were nothing like the markets that you see now. They were pretty immature, and they weren’t particularly liquid. I’d probably say that they are nothing like they are now in terms of the way that they function and work. The markets have gotten much more competitive as time has passed, but there is much more liquidity.

A particular aspect of change compared to the past is that there are many more niches in the markets nowadays. When I started, there were three or four vanilla strategies that you could use, which needed the best of your ability to see if you could squeeze some money out of the market.

The funny thing is, I started writing about trading and was doing presentations at financial exhibitions through the 2004/2005 period. But when you look at many of the strategies people talk about now, they come from that era.

There’s been very little original content that I’ve seen in the last few years, I recognise a lot of what I was saying in 2004/2005 circulating today which is quite weird for me to see. Contrast that with my time in the market, experience has allowed me to develop continually, progress, branch and mature key strategies

Analysing & comparing my early trades

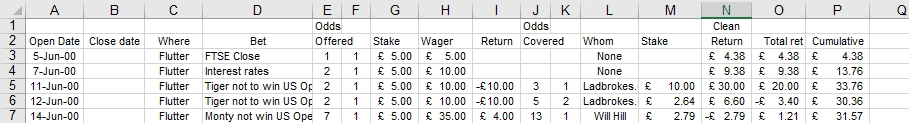

When you look at some of the early trades I have done, you’d see a bit of everything, a bit of horse racing and a lot of financial markets. I started in financial markets and then broadened out from there. I understood the nature of a football match well, so coming up with trading strategies was fairly straightforward.

I did a lot of financial market trading when I first went full-time to see what the market was like. Excuse the pun, but I hedged my bets!

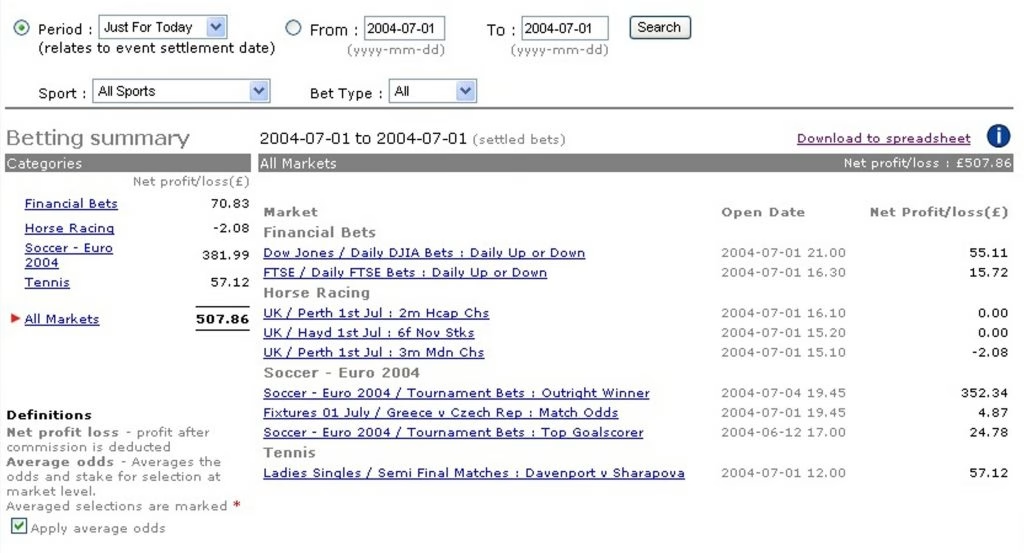

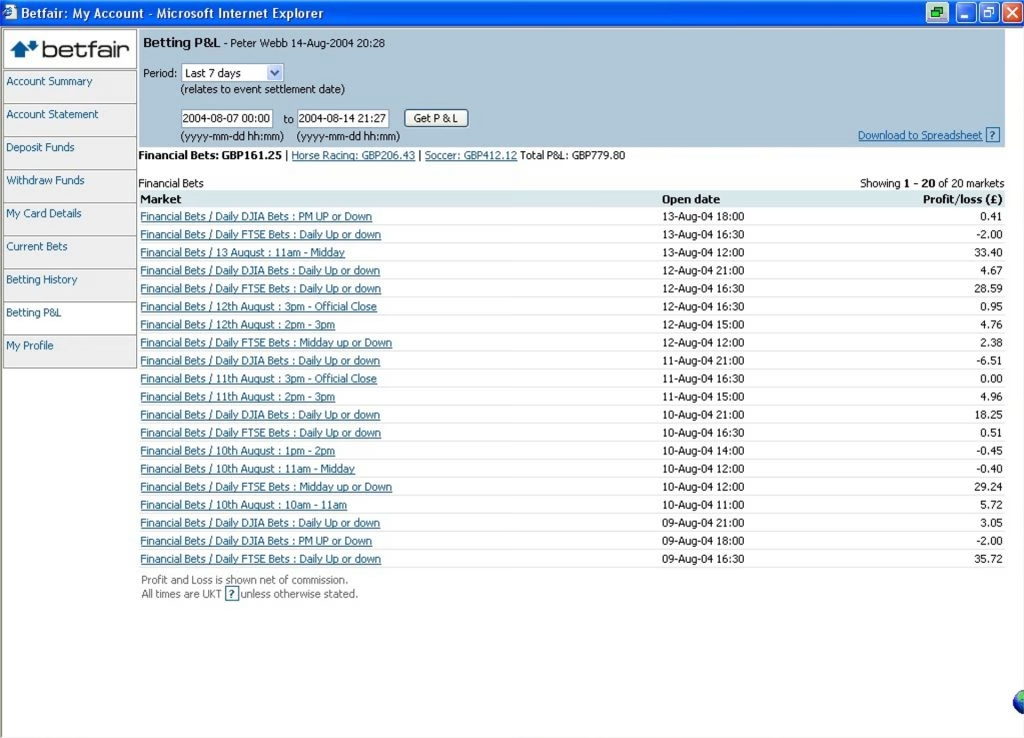

Looking at the profit and loss around that period, you will find that there are financial markets P & L’s within there. The interesting and curious thing about that is how these pages changed as I learnt my way around the markets. For example, in the image above, there’s a little bit of racing, some football in there, and then there’s financial markets trading.

So how did this change? My instinct to look at the football and financial markets changed as I shifted my focus. I broadened and decided to concentrate on the benefits of horse racing markets.

So what was it about the racing market that got me interested…?

I knew nothing about racing! I had no specialist knowledge, but the market was huge, it was billions. Compared to all of the other markets I was in, the financials were not doing a great deal of money; horse racing was incredible.

Leveraging my experience in financial markets, I decided to pre-race horse racing markets by trading order flow. I would back and lay to take small profits from each race by trading the underlying price movements. Lots of times I would make only small profits or losses but because there is so much horse racing, it all added up to a decent amount by the end of the week.

If you looked at a detailed ledger I kept for my financial markets trading on Betfair, you’ll see that I was still making quite a lot of money. The problem with that market is it didn’t grow… So, I turned my attention to racing. It was clear that the horse racing markets were obviously where a lot of money was bet, and the markets were huge. I knew that I had to get involved with racing!

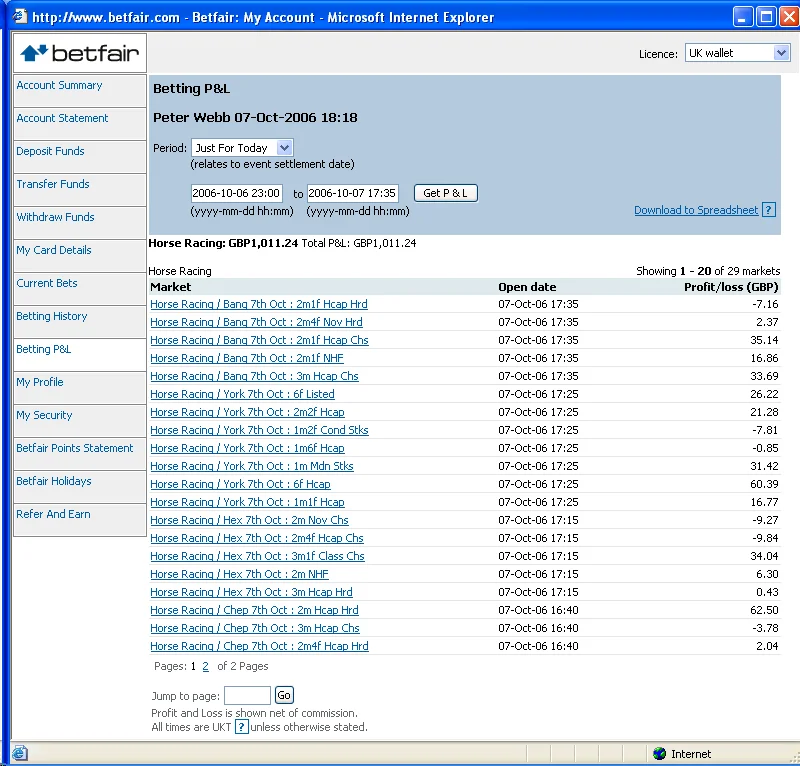

So, wind forwards a couple of years later, and you can see that my P&L on 7th October 2006, featured no football and no financial markets. It was all racing!

I knew if I mastered racing, I could make a living by effectively gambling on horse racing. What a crazy idea!

This was an excellent motivator for me to move on to racing. Of course, now there are many different markets you can pursue that have quite a lot of liquidity. Racing is still right up there, but there are plenty of markets that you can choose if you want to carve out a niche in that market.

As I started to focus more and more on those particular markets, everything began to grow slightly, but my skills and knowledge within that market also started to grow.

How I started to become more confident and a profitable Betfair trader

Like everything in life, the more you learn and become familiar with it, the more you’ll be able to excel at it!

My beginner learning processes – simplified!

First, you need to attempt to try and break even; consistently. Not losing money is always a good start before you can feel confident to make money consistently!

After reaching this stage, it was time to up the targets…

For example, I would wonder whether I could just squeeze £100 a day out of these markets. Of course, once you broke that barrier of making £100 a day, you start to wondered if I could get £500 and then it goes up and up and then suddenly you are now setting your goal to see if you can make over £1000 a day…!

Naturally, everyone’s learning process is different!

As a trader, your targets should mix, match, and change depending on what you’re attempting to do and how you’re attempting to do it. It also depends on what stage of your career you’re at, whether it’s your normal career, your trading career, it’s all going to be different for every single person when you first start out trading.

I remember Adam Todd posting P&Ls talking about making £20,000 a year. At that particular point, I was trying to get about £20,000 a month because I was thinking how hard and far I could push this. What can I achieve?

I didn’t want just to be able to trade. I wanted to do something special that somebody had never done before.

This has pretty much been my mantra throughout my entire career. I enjoy discovering new things, getting to grips with what I can see in front of me and trying to push the boundaries of what’s possible.

My first year using Betfair: profitable or not?

When you look at the equity curve from my first year on Betfair, it’s hard to pinpoint exactly when my first year was. It could be when I first joined, which would be quite a disappointing P&L! It could be from when I first went full-time, which would be slightly better. Or it could be when I started trading racing full-time…

But I counted my first year since I decided to start doing it seriously, and I decided to leave my salary job. Now I don’t have records for the first 24 weeks or so, not even detailed records, because I was messing around!

But by looking at my equity curve, the first part of the year, I made about £16,000, and then you can see the equity curve explode effectively upwards from there.

That was when I started to do more serious trading, looking at racing and other sports by trying to bring in more things from the mix. Watch the video if you want to see the equity curve.

The interesting thing about the graph, is that this was just the start...

This was pre-Bet Angel. The more I traded, the more effort I threw into it. I saw more potential opportunities. I just needed a platform on which to do them.

If we wind the clock forward and start looking at when I was becoming more sophisticated, I really started to understand what was going on with racing. Then, with the creation and introduction of Bet Angel into the mix, everything goes stratospheric from that point onwards. A range of strategies opened up to me, and things generally became much bigger!

When I first started, I was like any other beginner to a new task and I just remember hedging my bets a little bit. I didn’t have any preconceptions of what I wanted to do. But the only thing that drove me was that I’d just left a well-paid job, so I sure as hell needed to make up the income somehow!

That was a motivating factor for me when I first started. But really, the first year was a case of me finding my feet, trying to do something consistently and then starting to build from there. Then, of course, you throw Bet Angel into the mix, and opportunities appear everywhere.

I always worried about what could go wrong prior to me making that leap. In fact, what actually happened was, when I sat down and started doing it, all these opportunities opened up in front of me!

In hindsight, the thing that I had worried me most was the prospect of all this being a failure and my big leap being an absolute disaster.

I hadn’t thought about the other side of the equation, all of the things I would discover as I started doing it seriously. It was a salutary lesson.

When you start doing something seriously, and you throw a lot of energy and effort into it, you’ll really begin to find the true opportunity. Until then, there’s no way you can ever quantify or write a nice little business plan before you commit.

It’s only when you start doing it and start making progress towards those goals that you begin to understand where the opportunity is.

I hope that was interesting for you, reflecting on the trials and tribulations of my first year of Betfair trading and how I got there!

Hopefully, there are plenty of lessons for you.