From a £5 Flutter flutter to full-time

From the City to the exchange

Back in the summer of 2000 I was still knee-deep in financial markets, crunching numbers by day and learning how order books really work by night.

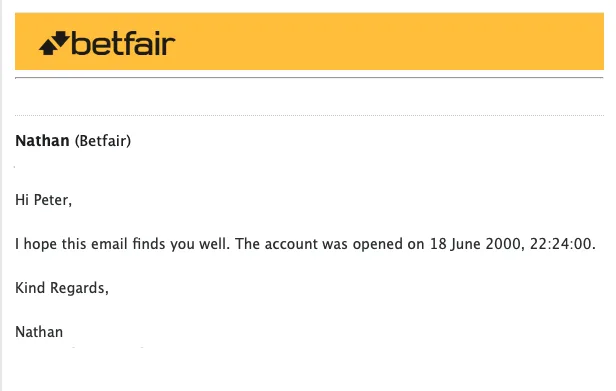

But the spark that lit the fire came on 18 June 2000 at 22:24, when I finally clicked “Open account” on Betfair. Another exchange, Flutter, had already caught my eye, yet it was Betfair’s peer-to-peer model that felt like the perfect playground for someone who saw markets everywhere – even on a golf course.

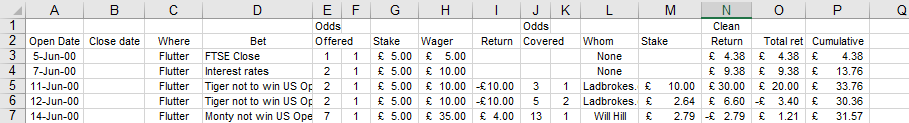

My first £5 on the US Open

Staying true to my risk-management roots, I started tiny.

A solitary £5 trade on the US Open Golf, arbitraging between bookmakers and the new exchange, may sound unremarkable. But it proved two things: the spreads could be beaten, and the technology really did level the playing field.

I’ve logged every click since – and that little flutter with Tiger Woods was where the story truly began.

Ring-fencing the bank – twice

I deposited roughly £1,000 and immediately split it in half.

One pot to trade with, one pot locked away in case a fat-finger error blew up the first.

That discipline, borrowed wholesale from the financial markets, spared me more than one sleepless night and let me scale up at my own pace. Risk, after all, is the only cost of doing business.

Slow, steady, scalable

Liquidity on early exchange markets was thin, so I focussed on incremental growth: trade, note, tweak, repeat. There was no epiphany, no overnight jackpot – just thousands of small edges compounding day after day. When I finally resigned from my very respectable day-job, the exchange bankroll was already big enough to make the decision feel dull rather than daring.

Turning data into an edge

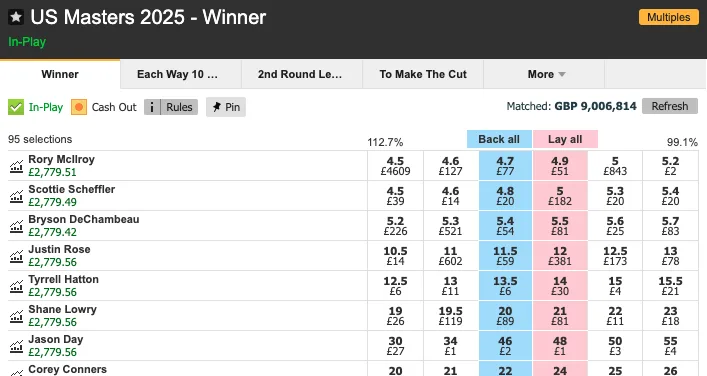

From that first Golf bet, I slowly became a market specialist. I built an odds model that blends course quirks, weather patterns and player tendencies – the sort of granular data the fixed-odds books still struggle to price perfectly.

Major championships, with their deep liquidity and razor-sharp spreads, remain my preferred hunting ground to this day. So each time a Major comes around, I can’t wait to get stuck in.

How I’ve grown

Fast-forward two decades to the 2021 US Open. Halfway through round two I posted a screenshot showing £800 fully hedged across the field – roughly 160 × that first stake.

The takeaway wasn’t the headline number; it was the timescale. Twenty-one years of compounding, refining and, crucially, tweaking got me from £5 to a near four-figure green screen.

The US open isn’t the biggest Golf event for me, that’s the US Masters thanks to it’s special status in Golfing calendar.

But whichever major you look at now, my turnover dwarfs those tiny origins.

What I’d tell the 2000-version of me

- Respect the bank – the safest capital is the cash you never risked.

- Seek liquidity – tight spreads and deep pools keep slippage in check.

- Log everything – the edge is usually hiding in your own data.

- Play the long game – confidence grows in direct proportion to screen-time, not stake-size.

- Ignore shortcuts – every “secret system” hawked online collapses under scrutiny; process beats promises every single time.

Betfair exchanges have evolved, technology has leapt forward and markets move quicker than ever, but one truth hasn’t changed: compound a small edge often enough and it becomes life-changing. If you’re prepared to be patient, disciplined and relentlessly curious, there’s no reason your own £5 flutter can’t snowball the same way mine did.