The Brutal Taxation Of Gambling

Only the bookmaker wins, bookmaking is a license to print money are popular phrases.

But in reality, only the taxman wins in the long term, and it’s getting worse. You have to question whether the knock-on effects will reduce the effective tax yield and negate a lot of the gain.

You also make the UK betting market less competitive and the black market more competitive and give it a massive hand in trying to drive people offshore.

This article explains how the tax structure works and why duty, operating costs and corporation tax significantly reduce the true profitability of gambling operators.

Understanding Gross Gambling Yield (GGY)

UK gambling operators are taxed primarily on Gross Gambling Yield rather than net profit.

GGY is defined as:

Stakes taken – winnings paid out to customers.

It is the equivalent of a bookmaker’s gross margin before any operating costs. Crucially, most gambling duty is applied directly to this figure.

For customers, GGY is invisible. For operators, it is the number that dictates almost everything about their business model.

How Gambling Duty Reduces Margins Before Costs

Unlike most industries, gambling companies pay a tax before they deduct any of their running costs. Remote Gaming Duty (RGD), General Betting Duty (GBD) and Machine Games Duty (MGD) are all calculated on GGY, not profit.

For example, a remote gaming operator faces a 21 % duty on GGY (prior to the 2025 changes). So:

- A company generating £100 m GGY pays £21 m duty immediately.

- It is left with £79 m before it has even paid a single member of staff, run a website, or complied with regulation.

This upfront taxation model is why headline revenues can mislead outsiders into thinking gambling is far more lucrative than it is in practice.

The Role of Operating Costs

After duty comes the hard reality of day-to-day business expenses. For many traditional operators, operating costs can consume 40-60 % of GGY.

This includes:

- Staffing and premises

- Marketing and customer acquisition

- Technology systems and risk-management teams

- Payment processing, fraud prevention and chargebacks

- Safer-gambling measures and regulatory compliance

- Sponsorship and brand visibility

Using the earlier example (£100 m GGY → £79 m post-duty):

If operating costs sit at around 50 % of GGY:

- Duty reduces £100 m to £79 m

- Costs reduce £79 m to around £29 m

That £29 m is the figure the company must then pay corporation tax on.

Corporation Tax Takes the Final Slice

Corporation tax, currently 25 %, applies after duty and costs.

On £29 m of pre-tax profit, that tax bill is roughly £7.25 m, leaving around:

£21.75 m actual net profit from the original £100 m GGY.

While that may sound substantial, it is only 21-22 % of gross gambling yield. When expressed as a percentage of total customer stakes—often measured in billions—the net margin becomes incredibly thin. Almost vanishingly thin.

The Impact on a Traditional Bookmaker

Traditional bookmakers face an especially difficult balancing act:

- Margins in sports betting are inherently low.

- Duty is applied regardless of whether the operator made an accounting profit.

- Marketing costs are rising, especially for online acquisition.

- Compliance and safer-gambling controls are increasingly expensive.

- Competition from exchanges, casinos and international brands further squeezes pricing.

This means bookmakers must operate with extreme efficiency. A small drop in margin, a regulatory change, or an increase in duty can dramatically affect profitability. Many smaller firms have exited the market for this reason.

Tesco’s as a Bookmaker

To show how extreme a 40 % duty on gross gambling yield really is, imagine applying the same approach to a normal retailer like Tesco.

In its latest results Tesco generated around £5.16 billion in gross profit, but a 40 % tax on that figure would strip out more than £2 billion before the business could pay a single bill.

That would leave barely enough to cover its operating costs, wiping out much of its remaining profit and threatening the viability of a company built on tight retail margins. No supermarket could function under that model, yet this is effectively the tax environment gambling operators are being pushed into under the new duty regime.

To put that into perspective, based on last year’s figures, that type of tax would reduce their profits to about 0.81% of turnover. Good luck with that!

How Betting Exchanges Are Taxed Differently

Betting exchanges such as Betfair or Betdaq do not act like bookmakers. They do not hold risk on outcomes. Instead, they take a commission on customer winnings, which forms their GGY.

However, the principles are the same:

- Commission = their GGY

- Gambling duty is charged on that GGY

- Operating costs and corporation tax still apply afterwards

This leads to several unique pressures:

- GGY depends entirely on activity.

Exchanges earn less during quiet periods or when markets become more efficient. - Duty is applied even in markets that generate minimal net revenue.

If customers win and lose in rapid cycles, the exchange may recognise GGY without meaningful profit. - Heavy technology and infrastructure costs.

Exchanges operate real-time trading technology, matching engines and risk systems comparable to financial exchanges. - Customer acquisition is expensive.

These platforms need constant liquidity to function. Without active traders, the model breaks down.

Because exchanges earn only a fraction of the stakes matched on their platform, even small changes in duty or PAYG costs can have large effects on their margins.

New Tax Landscape: Budget 2025 Changes

Significant changes were announced in the Autumn Budget 2025 which will materially affect the taxation regime for gambling operators. The key shifts include:

- The rate of Remote Gaming Duty (online casino-style games of chance) will increase from 21 % to 40 %, with effect from 1 April 2026.

- A new remote-betting rate within General Betting Duty for online sports betting will be introduced, rising from current 15 % to 25 %, from 1 April 2027. (Retail/high-street betting and horse-racing bets remain at 15 %).

- Bingo Duty will be abolished from 1 April 2026. I’ve no idea why Bingo is exempt?

- Casino gaming duty bands will be frozen for 2026-27, meaning indirect rate increases.

What this means in practice:

- For online casino/gaming operators, the duty component of their margin will nearly double. What was 21 % of GGY will now be 40 %.

- For online sports-bet operators (including bookmakers’ online channels), the duty will rise from 15 % to 25 % (though not until 2027).

- For exchanges, their commission-based model is not explicitly singled. But it will reduce margins.

- Operators may respond by either raising prices (i.e., reducing payouts/worse odds), reducing marketing offers, withdrawing less profitable products, or scaling back UK operations.

- A rise in tax burden raises risk of consumer migration to unregulated/black-market offerings, which could reduce overall market size.

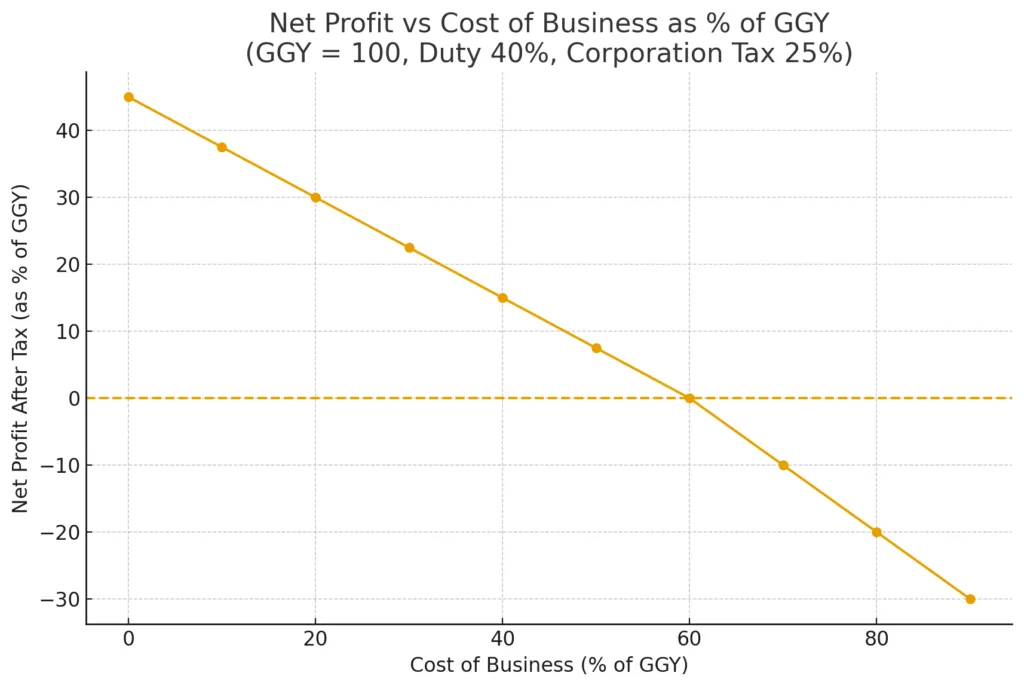

Illustrative margin impact (using earlier £100 m GGY example):

- Pre-budget duty at 21 %: £100 m → £79 m after duty.

- Post-budget duty at 40 %: £100 m → £60 m after duty (assuming same GGY).

- If costs stay the same (say £50 m) then pre-tax profit drops from ~£29 m to ~£10 m.

- After 25 % corporation tax, net profit might fall to ~£7.5 m (versus £21.75 m before).

- That’s a drop from ~21.8 % net margin on GGY to ~7.5 %.

- The real operator response might include cost cuts, product rationalisation, fewer marketing offers, lower odds/payouts, etc.

In short: margins for operators are under serious pressure going forward.

Why the Public Often Misjudges Gambling Industry Profits

From the outside, the numbers look enormous. Billions staked, millions of customers, huge advertising budgets — and the perception that “the bookies always win”.

But when duty slices off 15-40 % of gross yield before anything else happens, and compliance and staff costs eat up another 40-60 %, the remaining profit is nothing like the public imagines.

With the new tax increases, the difference between revenue and bottom-line will become even more stark.

Final Thoughts

The UK’s gambling tax structure is designed to ensure that operators contribute heavily to the Treasury. But the way this system taxes gross gambling yield rather than net profit means operators face a uniquely challenging margin environment.

Traditional bookmakers must balance low sports margins against high compliance and duty costs, while betting exchanges face the additional burden of maintaining enormous technical infrastructure with relatively slim commission revenues.

With the Budget 2025 changes, the pressure on online-only and remote gambling models will intensify.

Curiously, increased taxation will force operators to increase yield, meaning worse odds and therefore problem gamblers will lose quicker than before. Well done anti-gambling campaigners, you just made things worse.

As odds get worse, it will be much easier for attractive offers and odds to come from outside of the heavily taxed and and heavily regulated framework in the UK. It’s boom time for black market operators.

A curious side effect of all this on betting exchanges is that, given their business model, odds on sports markets are very competitive and much more attractive.

But whether commissions can be kept low, is another question!