Trading day to day horse racing markets

Coming back to reality

I’ve made it no secret that I like those big meetings, so what makes them so great?

My strike rate is exceptionally high at these big meetings and this means I’m very likely to get a positive trade out of any individual race and a big result on the meeting. With this in mind, am I going to stick in fivers as tenners on each trade? No, I’m going go for it and you’re going to throw as much money at it as you can.

That’s why I like the big meetings because know I’m probably likely to win…It’s just a question of how hard can I push it!

Personally, I push really hard during these big meetings and that’s why I get those big results. However, big results are typically unusual. Therefore, you shouldn’t set your bar at a five, six hundred or consecutive amounts like that – you want to set your bar much lower. The reason for that is the market in general can’t tolerate bigger staking.

So when we transition out of a big meeting back to more standard fodder, you’re going to have to reappraise the way that you trade, but that’s fine, that’s exactly what you do. I flex my trading style depending upon what’s in front of me.

How I change my approach each week

It is the same coming out of a big meeting, there’s no way when I look at an ordinary racing card that I’m going to be using two and a half grand stakes to trade a race day because the market just will not take it. Using large stakes in small markets means the market will do one of two things. It could:

1) stop the activity in the market at that particular point as I’m trying to get an order filled and it won’t pass through it.

2) the market could get scared and start running away from your order and therefore you can’t get filled when you’re attempting to close your order.

It’s important to understand that you’ve got to flex in and out depending upon what’s in front of you. If the market’s got loads of money coming through, you’re expecting the match amount matched to be very high, then you can increase your stakes and you can really do a lot within that particular market.

But if that’s not there, then you just pull your risk down by reducing your level of stakes. While it’s lovely to see those big greens that I post after big meetings. It’s not realistic to think that that’s typically how the market trades. Only at a big meeting like Ascot, Cheltenham or the Guineas you can sort of expect to get some big totals.

Of course, if you’re starting out or you’re an intermediate trader, you’re not going to have enough practice at these big meetings to be able to push really hard. This will mean that you may not get the result you wanted.

The thing that I’ve noticed at Cheltenham this year was that the queue size is getting smaller and that’s because the market’s getting a little bit more volatile. So that’s actually bringing in the opportunity for people to trade it a bit more conventionally like you see on a day to day basis

Assess your risk

But as we transition out of those big meetings and in to the normal type of trading that you expect to see, it’s really worth trying to stay out of trouble, not doing anything stupid. You have to remember that it is really a case of trying to get a good result overall.

It may not sound impressive, but getting it is worth getting an average of £10 a race. I say this to put some context of when you’ve just seen me post a P&L of £500 that I’ve managed to achieve at a Cheltenham or a big meeting. However, it’s those everyday results which are the ones that become really important because over the course of the year, you could easily do 10,000 of those!

So if you can average £10 a race, for example (I’m not setting an expectation here – a random statistic!) and you’re doing ten thousand races – that’s obviously a lot of money you can make in the end. You could even set it much smaller and still achieve something great, but the way that it arrives is going to be very different from what you would expect at a major meeting.

At a major meeting, I expect a string of profits and I’m pushing as hard as I can to make those profits as big as possible. Every now and again, I screw up and one of those races that really should be in a profit isn’t and it just falls off the edge of a cliff. It’s at that point that I realise that I pushed too hard.

It’s rare to get all of them absolutely correct and you usually mess up on one or two. However, when I’m trading during a ‘normal’ week I’m going to be very defensive compared to big meetings. I’m going to lower my stakes right down and I’m planning not to make any mistakes.

My final profit comes from a combination of profits and losses, looking for an overall average profit figure.

Understanding the bigger picture

When trading in every day markets, I’m not looking to go on some ridiculous run or bag some enormous amounts of profit on each individual race or market. The way that I’m going to do it is I’m going to say, ‘I’m going to trade 30, 40 races over the course of the day and I’m going to end up ahead of things by the end of the day.’

So, for example, if you have a strike rate of 75% and then you’ll make a tenner 75% of the time, but you lose £20 25% of the time, you end up plus £10 over the mix of 10, 20, 30 or so races. So the strike rate and the amount you win and lose are going to interact quite heavily. The way that they often interact tends to be uneven. I’ve given you a very clear number here and people love clear defined numbers, but it never works like that.

The reality is you’re P&L is going to be more like, -£5, + £10, -£7, +£20, -£30, +£75…

It’s a really bumpy journey all the way along and at the end of that you’ll end up with a strike rate of some level, 60, 70% or something. It’s the mixture of your strike rate and the profits and losses that deliver you the profit at the end of the week.

Keep chipping away!

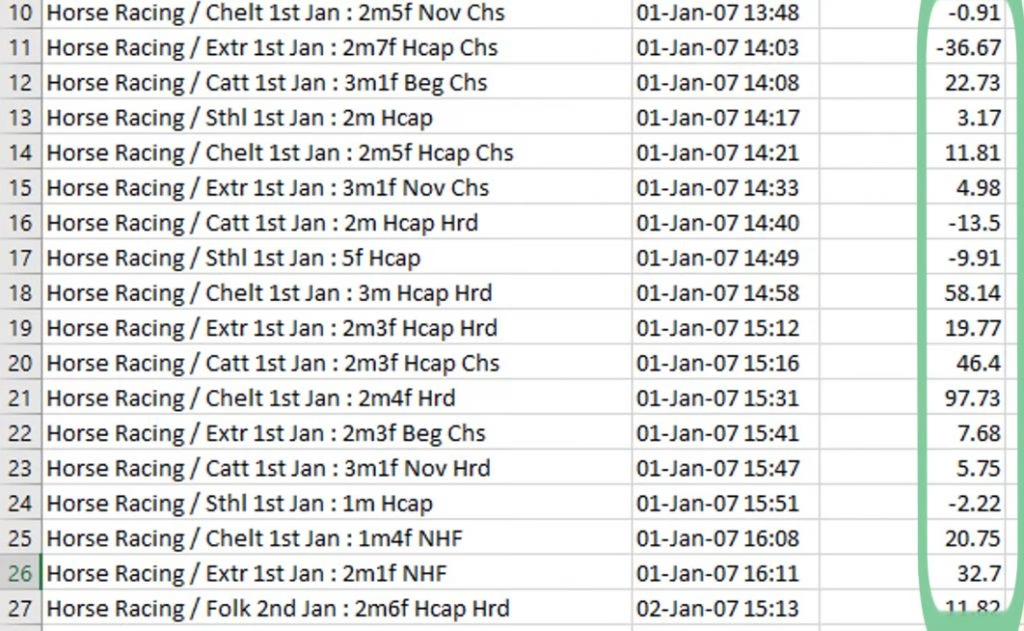

Now, I’m going bring up a spreadsheet here of some activity way back in 2007.

If you look at the way that the P&L was created, I ended up on a very big total by the end of the month. As you can see the total was made up of loads of little positives and negatives and I just kept on chipping away.

The methodology that I have is that I chip away at the market and I’m trying to get a profit at relatively low risk.

I don’t know how that profit is going to arrive – it’s basically going to be positive here, negative, positive, positive, negative. I’m just trying to make a good decision based upon what I see in the market. Generally, what I’m trying to do is avoid a loss. I’m trying to get myself in the position where the chance of a loss is much lower and then profits arrive off of the back of that.

That’s generally how I tend to trade, trying to get myself into a good position where a loss or a chance of a loss is minimised and then I’m letting the profit run. If the profit starts to look good, then I may just push a little bit harder and try and get that profit a little bit higher.

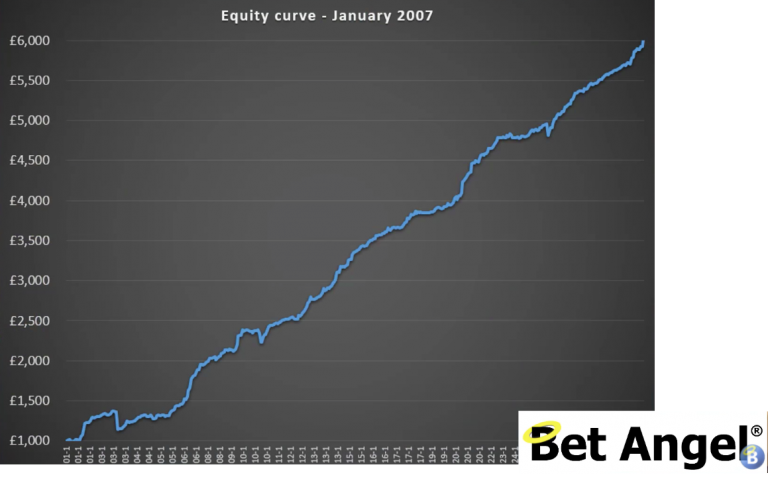

But generally, the sequence of events almost looks random. If you look at the progression by looking at the equity curve over the course of this particular month in January 2007, you can see the equity curve seems to just smoothly go upwards with a little couple of bumps.

You will get the odd cock up and the odd positive result, but generally, the equity curve rises smoothly. When you look at the individual results, you’ll notice that there’s a right old mixture in there. Some are quite positive, some are negative and there’s no clearly defined path. If you’re trading properly, that’s typically what you tend to find.

If you wind forward over a number of years, that’s more or less exactly the way that my P&L looks outside of a big meeting. I’m getting little profits, I’m getting little negatives and overall it’s all coming out in the mix by the end of the week, by the end of the month, by the end of the year. The advantage of doing it this way is the more markets you trade than generally, the more money that you make.

Finding the balance in an unbalanced environment

You’re trying to get as many trades through as possible, in as many markets. The more that you do that, knowing that you have a positive expectancy, means that you typically end up over any particular period. That’s why I like racing, because those positivesand negatives balance themselves out really, really quickly and over the course of the week, you can do pretty well.

Even though you’re probably not going on any particular long winning run – just think about it you’re not really going on any particular long losing run either!

The way that the results appear won’t be random because you’ve got some logic in there, but they’re just not coming in a regular pattern. That can be frustrating at times because you can be chipping away for ages and nothing will happen. But then you get that big result or, of course, you could get a negative. Then you would just gradually chip away at it with loads of positives.

Why positive expectancy catches out new traders

Sometimes this is what catches people out when trading because it doesn’t have that nice, smooth approach. It can be a little bit stressful when you’re having a bad day, on the contrary having a good day can lead to overconfidence.

So typically, my attitude & desire, when we trade on a normal week. Is just to do the best I can in every individual market. The goal is to try and minimise where I’m likely to make a loss by maximising the entry positions within the market and managing the trade well. I’ll also adjust my staking to help. Then I’ll continue to chip away at each market as frequently as I can to try to end up to a bigger total at the end of whatever period I’m measuring over.

When you first start, I suggest you measure over a month, but maybe when you’re a bit more experienced you’d want to measure over a week. By measuring on an individual day or checking your P&L as it is progressing is a disaster because it will influence the way that you trade the next market. Whether you’re behind or ahead will lead alter the way that you trade the next market.

So all I do is just chip away each market, do the best that I can. And then I look at the P&L at the end of the day and go, ‘oh, yeah, that went well! Or maybe I’ll do better tomorrow.’

But it’s also important that when you’re coming out of a big meeting, don’t believe these big meetings are the norm!

The mundane stuff is where a lot of the money comes from and it’s going to be small positives and small negatives, but adding up over a period of time. So, prepare yourself for those types of markets as they make up the majority of what you will do over a year.

Get those right and approach them in the right manner and you will do well over the course of the year.