My first sports trading market

On the 18th of June 2000, at precisely 22:24, I made a decision that would change everything—I opened my Betfair account. And as they say, the rest is history.

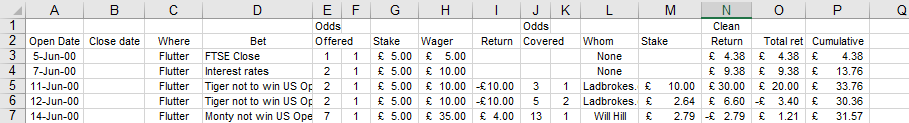

Interestingly, Betfair wasn’t the first betting exchange I explored. Back then, there were several options available. My initial foray into this world was with Flutter, which, alongside Betfair, soon became a leading exchange until they eventually merged.

My first significant venture into sports trading was on the US Open Golf. However, my journey began in financial markets, which naturally led me to explore financial exchanges first.

I’ve meticulously documented every step of my journey from that initial bet. That’s how I know my first sports trade was on the US Open Golf, where I was arbitraging between bookmakers and the exchange. It wasn’t particularly impressive, but it was the start of something extraordinary.

Starting out with a small bank

From that simple start, I began to build—not just my confidence but also the money in my account. In the early days, I set up an account and deposited a fixed amount. Although I can’t recall the exact figure, it was likely around £1000.

To safeguard against errors, I split my bank in two, keeping half as a ‘reserve’. This way, if I made a mistake, I could fall back on the reserve, regroup, and start again. Fortunately, I never needed to dip into that reserve.

This discipline stemmed from my experience in financial markets, where I learned the hard way that discipline is crucial. You need the freedom to seize opportunities, the courage to take risks, but also the wisdom to manage those risks effectively.

Starting small, I gradually increased my stakes as my bank grew, ensuring I never risked my entire bank at any point.

Slow and steady wins the race

Of course, my modest efforts at the beginning of my career weren’t enough to achieve something truly special, which is ultimately what I aimed for.

I had a well-paid job, but I saw a promising opportunity in betting that I wanted to fully embrace. The main challenge was figuring out how to bet at a level that would allow me to take this seriously. The exchanges had low liquidity, and small stakes wouldn’t suffice. Plus, as a beginner, I didn’t yet know the limits.

So, I took a gradual approach. With each market, I incrementally increased my stakes and deepened my understanding of individual markets. There was no sudden breakthrough, no overnight revelation—just steady, incremental progress. Over time, my efforts paid off, and the numbers grew large enough for me to confidently quit my job and pursue this full time.

What my US Open Golf bet looks like now

Since that first bet on the US Open Golf, I’ve spent over 20 years refining my understanding of the sport, from individual courses and players to the nuances of tournament play. Along the way, I developed an odds model specifically for golf.

In the beginning, this seemed impossible. However, as my knowledge expanded and I observed more markets, I figured out how to make it work.

Naturally, my confidence has grown. Now, when I place a bet or take a trading position in a golf market, I have a strong sense that things will turn out well overall. While certainty is never guaranteed, experience breeds confidence, allowing me to make more decisive and firm choices.

Gaining confidence and increasing my stakes

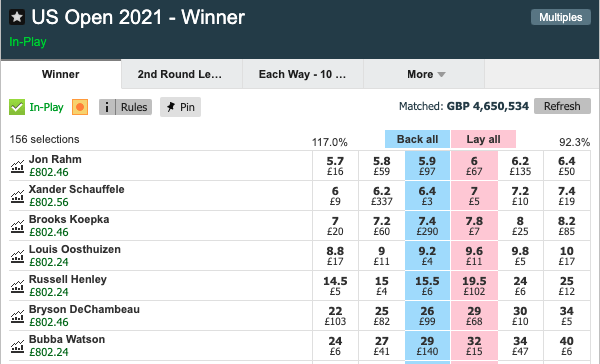

Now, let’s talk about staking. Over the years, I’ve gradually increased my stakes. Using small stakes means you won’t accidentally influence the market, but if they’re too small, your profits will be minimal. There’s a sweet spot where you can use reasonable stakes without swaying the market. This is why I focus on the Majors—they offer the perfect blend of tight spreads and high volume.

For example, I took a screenshot of my Betfair trading profit for the US Open just before the end of the second day in 2021. My fully hedged profit across the field was £800—160 times my initial stake from twenty years ago!

However, this dramatic rise didn’t happen overnight. It was a slow, methodical process, built step by step over twenty years in a deliberate, confidence-building, and structured manner.

So, when you see trading images like the one I posted, remember that reaching the same goal takes time. There are no shortcuts, and attempting one might actually hinder your chances of success. But if you’re willing to work hard for long enough, there’s no reason you can’t achieve the same results.

Ultimately, you need a thorough understanding of your tactics, the market, and the sport.

Confidence comes from experience, and there’s no shortcut to that. Keep practising, avoid reckless decisions, and stay patient. As long as you’re doing the right things, time will always reward you.