Using variable staking to minimise your losses

I recently saw a discussion about my unusual staking patterns in my Betfair trading videos. It made me realise that many people are curious about the logic behind my staking approach. So, I decided to create a comprehensive blog post to explain how and why I stake the way I do.

The Logic Behind My Staking Strategy

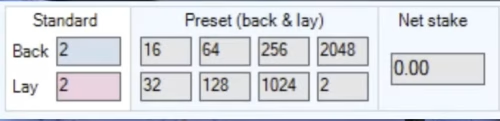

When you watch my videos, you’ll notice that my stakes often follow a pattern: 16, 32, 64, 128, 256, 512, 1024, and sometimes 2048. This may seem odd at first, but there are specific reasons for this approach. The first is that I need to have multiples of the same amount, but the reason why is more interesting.

Confidence-Driven Staking

One of the key factors in my staking strategy is my level of confidence in a trade. If I’m confident that a trade will work out, I’ll be more aggressive and use larger stakes. On the other hand, if my uncertainty increases, I’ll reduce my stake. This method helps me manage risk effectively within the market.

Grading Markets and Managing Risk

Each market is graded based on my ability to read it. For example, if I see a “10 out of 10” market where I’m almost certain of the outcome, I’ll stake a large amount of money. Conversely, if I’m unsure, I’ll lower my stake to manage the risk. This approach ensures that I’m always balancing my stakes according to the market’s conditions.

Market Liquidity and Its Impact on Staking

The liquidity of the market also plays a crucial role in my staking strategy. For highly liquid markets, like the Grand National, I can place larger stakes without significantly impacting the market. However, in less liquid markets, I use smaller stakes to avoid influencing prices and to ensure I can exit positions without causing adverse price movements.

Preferring Multiple Small Trades

In my trading, I often prefer multiple smaller trades over a single large one. This strategy reduces my visibility in the market, preventing it from moving against me. By dribbling money in and out, I can achieve a better average entry and exit without drawing attention. I also ‘fit’ within the market volatility.

Those Odd Staking Patterns

Interestingly, my preference for stakes that are multiples of each other (like 16, 32, 64, etc.) stems from my early days in the computing industry, where I learned the binary numbering system. This pattern has stuck with me and now helps me scale in and out of trades smoothly, adjusting according to the level of risk and liquidity in the market.

Understanding My Staking Approach

In summary, my staking strategy varies according to my confidence in the trade, the underlying market conditions, and the market’s liquidity. By using this method, I can manage risk effectively, avoid detection by the market, and optimise my trading performance. It’s easy to get into an order and often a bit harder to get out, by varying my staking and scaling in and out of a trade, I can help align my stake to risk.

This helps me win more when I’m confident about a trade or market, and lose less when I’m less confident.

I’d recommend you follow the same approach.