Betfair trading pre-off Racing with small stakes

I can trade with small and big stakes, but I obviously prefer to trade with bigger amounts! I realise many people who start trading will be using small banks, and that’s what I want to talk about in this article. I hope this can be useful for someone who is starting out or who wants to boost their confidence by starting with smaller stakes.

Why small stakes are easier to trade

In this example, we specifically look at trading horse racing. There is no particular strategy in use here. I’m not swing trading, using the weight of money or anything specific. I’m just adjusting my Betfair trading strategy based on what I see in each market.

I could be looking for very short-term price movements or a long-term trend. Each horse racing market is different and your strategy should reflect that. That is why there are so many options on trading software like Bet Angel. To give you the options to trade a market in many different ways.

One of the interesting things when you go back to using small stakes when race trading, is you realise how much easier it is to get those stakes through the market. When you look at the risk involved with the trade, if you open a position here and you close a position there, then you’ve got this spme time between the two of them, that’s the risk that you’re taking. You open a position, you close it.

Now, when you open a position, you hope to close it to lock in a profit, but you may scratch that trade for no profit or loss, and we may close it for a small loss. The longer you let a position run in the market, the more profit or loss will accrue.

So, if it’s going wrong, you want to cut it out as quickly as possible.

The difference between small and large stakes when things go wrong!

With a small stake, you can go in and out of the market, and it happens pretty quickly. However, when using a large stake, the problem is I have to ease my position into the market, get a decent stake and then ease the position out; that’s how I tend to work.

Typically, I don’t go into the market and go boom! There are situations where that occurs sometimes by accident, sometimes by design, but generally, that’s not how I work.

I’m effectively trying to hide in the market because people start trying to work against it when you expose a significant stake. It’s much easier for me to dribble a position in and then gradually take it out. You will see this frequently when I produce Betfair trading videos; I follow the exact process.

When you use small stakes, you realise you can get them in and out quite quickly. The interesting thing about using small stakes is that your percentage return should be much higher than somebody using more significant stakes.

Example of a small stake Betfair trading

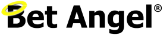

In this example, I’ve got back to trade on smaller stakes. If you look at all of the trades that we did on this particular day, there are 15 betting markets in total.

I won on most of them, and my strike rate came out at around 80%, and that’s pretty typical of what I would expect. But if you look at most of these trades, they’re relatively minor. I was trying to use as much as possible, but only had a bank of around £400. So I was always up against that limit, and I wanted to use more money in some of these trades, but I couldn’t.

I had to restrict my trades to much smaller levels and work within those in the market to try and get something out of the market.

This teaches you that you’re objective in the market is to focus on the quality of the trade, not necessarily the quantity.

A lot of these values are pretty small. There’s £2 and £3 here and there, but if you’re going to trade ten thousand markets, then, you know, getting £2 out of a market on average over 10000 markets gives you a decent chunk of money. That longer-term focus is how you achieve significant results over the year.

You may have said no if I had asked if you could make £20,000 trading the year. But if I say you could get £2 on average, you would probably feel that was much more achievable.

When you get those small averages, you can hopefully push higher and scale your stakes up to more significant amounts.

Everyone makes mistakes and losing trades

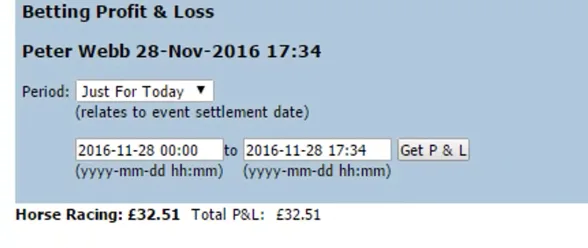

You can also see that I made a complete mess of one race and lost all in one go – that’s not unusual!

Over a day, you will get a ‘problem trade.’ However, as long as you’re consistent in terms of the way you approach the market generally, everything will average out. You’ve got to expect that there will be duff trades coming through the market at some point. Expecting the odd howler is the best way to deal with the emotional baggage you get with it.

Usually, it’s down to things that you have no control over. You could do something, and then it all unravels for one reason or another, or somebody knocks on the door, or you’re distracted…you just have to accept it! Don’t blame it on anything else; accept it and move on to your next target.

I’m always confident that I will make money by the end of the day. I can’t say how much I will make, but I’m pretty confident by the end of the day I will. That allows me to overcome any losses that I’m likely to make, because when I’m progressing through the day, what will happen is that I will eventually get that loss back.

Having done this for many years, this is the approach I’ve adopted every day with confidence. Even if I get an early loss or a significant loss mid-afternoon, I just keep on ploughing on and expecting that to turn alright at the end of the day.

I don’t sweat over a lousy trade nor celebrate a great one. It will all come out in the wash by the end of the day.

Small stakes can give you a good profit

While £30 doesn’t seem much, if you look at the total, we ended up earning as a percentage. That’s a reasonable return of £30 from our £400 bank account.

Often, trading over the day doesn’t give you one particular trade that gets you all the profit. Loads of little bits gradually add up to more significant amounts.

Of course, we’re using that £400, and we may use it more than once in a market; we may also use smaller or larger amounts. If you look at all of the individual transactions I did over the day, some of them are bigger than others, but that reflects my confidence in the trade.

I’ll often start with a set amount of money, and I think, ‘Yeah, this is going alright!’ So I’ll add to it, and we’ll build the trade, and we’ll make the trade much more interesting as it goes along.

However, if I’m not confident, I may not trade at all, or I may put my first trade-in and then start going, ‘hmm, not so sure…’ and then not increase the stake at all or put any additional trades into the market.

Each of these individual results was created with different amounts of money. However, it’s the ability to keep putting that money through the market, which is one of the enormous benefits of trading. The more money you put into the market, as long as you trade it even marginally positive, the better you will be at the end of the day.

I wanted to show you that it is possible to trade with smaller stakes and get a reasonable return out of it. Now, you won’t retire on £30 quid a day. But when you’re starting out, the idea is that you you can earn reasonable returns on your money that you just gradually increase your stake over time and that translates into a bigger profit at the end today. Compounding 10% a day will get you to higher stakes fairly quickly.

I only started with a small bank

On a decent race I’ll easily trade a five figure amount, if we get a really big race I’ll push to get over six figures. While those numbers sound huge, they were built from a very low based and grown gradually.

That’s how I started – I started with a tiny bank and then just kept on reinvesting the money until gradually the stakes started to curve upwards. Then it gave me the confidence to start using larger amounts without even realising it. I become very comfortable with using larger amounts as I had worked slowly to reach that point.

From a stress perspective that makes sense as well, it gives you the ability to not have to worry too much about the stakes you’re using and you can just get on and do it. If you jump into a market with large stakes straight away, the pressure will force your hand and most likely lead to a bad result.

So I hope this has shown you what an average day can look like using small stake. Hopefully the screenshots in this blog and my explanations on how I approach small stakes, will give you a bit of an insight as to what goes on over the course of a typical trading day and allow you to trade it a bit more confidently!